Form Dr 659 - Florida E-Services Programs Calendar Of Due Dates For 2005

ADVERTISEMENT

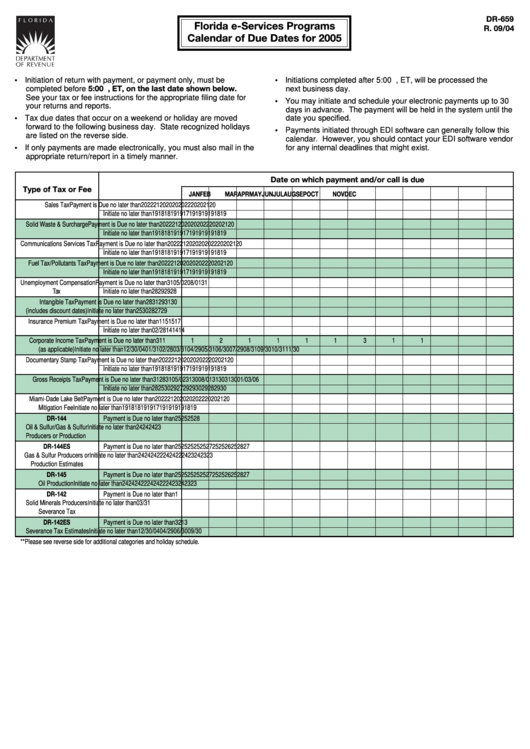

DR-659

Florida e-Services Programs

R. 09/04

Calendar of Due Dates for 2005

• Initiation of return with payment, or payment only, must be

• Initiations completed after 5:00 p.m., ET, will be processed the

completed before 5:00 p.m., ET, on the last date shown below.

next business day.

See your tax or fee instructions for the appropriate filing date for

• You may initiate and schedule your electronic payments up to 30

your returns and reports.

days in advance. The payment will be held in the system until the

• Tax due dates that occur on a weekend or holiday are moved

date you specified.

forward to the following business day. State recognized holidays

• Payments initiated through EDI software can generally follow this

are listed on the reverse side.

calendar. However, you should contact your EDI software vendor

• If only payments are made electronically, you must also mail in the

for any internal deadlines that might exist.

appropriate return/report in a timely manner.

Date on which payment and/or call is due

Type of Tax or Fee

JAN

FEB

MAR

APR

MAY

JUN

JUL

AUG

SEP

OCT

NOV

DEC

Sales Tax

Payment is Due no later than

20

22

21

20

20

20

20

22

20

20

21

20

Initiate no later than

19

18

18

19

19

17

19

19

19

19

18

19

Solid Waste & Surcharge

Payment is Due no later than

20

22

21

20

20

20

20

22

20

20

21

20

Initiate no later than

19

18

18

19

19

17

19

19

19

19

18

19

Communications Services Tax

Payment is Due no later than

20

22

21

20

20

20

20

22

20

20

21

20

Initiate no later than

19

18

18

19

19

17

19

19

19

19

18

19

Fuel Tax/Pollutants Tax

Payment is Due no later than

20

22

21

20

20

20

20

22

20

20

21

20

Initiate no later than

19

18

18

19

19

17

19

19

19

19

18

19

Unemployment Compensation

Payment is Due no later than

31

05/02

08/01

31

Tax

Initiate no later than

28

29

29

28

Intangible Tax

Payment is Due no later than

28

31

29

31

30

(includes discount dates)

Initiate no later than

25

30

28

27

29

Insurance Premium Tax

Payment is Due no later than

1

15

15

17

Initiate no later than

02/28

14

14

14

Corporate Income Tax

Payment is Due no later than

3

1

1

1

2

1

1

1

1

3

1

1

(as applicable)

Initiate no later than

12/30/04

01/31

02/28

03/31

04/29

05/31

06/30

07/29

08/31

09/30

10/31

11/30

Documentary Stamp Tax

Payment is Due no later than

20

22

21

20

20

20

20

22

20

20

21

20

Initiate no later than

19

18

18

19

19

17

19

19

19

19

18

19

Gross Receipts Tax

Payment is Due no later than

31

28

31

05/02

31

30

08/01

31

30

31

30

01/03/06

Initiate no later than

28

25

30

29

27

29

29

30

29

28

29

30

Miami-Dade Lake Belt

Payment is Due no later than

20

22

21

20

20

20

20

22

20

20

21

20

Mitigation Fee

Initiate no later than

19

18

18

19

19

17

19

19

19

19

18

19

DR-144

Payment is Due no later than

25

25

25

28

Oil & Sulfur/Gas & Sulfur

Initiate no later than

24

24

24

23

Producers or Production

DR-144ES

Payment is Due no later than

25

25

25

25

25

27

25

25

26

25

28

27

Gas & Sulfur Producers or

Initiate no later than

24

24

24

22

24

24

22

24

23

24

23

23

Production Estimates

DR-145

Payment is Due no later than

25

25

25

25

25

27

25

25

26

25

28

27

Oil Production

Initiate no later than

24

24

24

22

24

24

22

24

23

24

23

23

DR-142

Payment is Due no later than

1

Solid Minerals Producers

Initiate no later than

03/31

Severance Tax

DR-142ES

Payment is Due no later than

3

2

1

3

Severance Tax Estimates

Initiate no later than

12/30/04

04/29

06/30

09/30

**Please see reverse side for additional categories and holiday schedule.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2