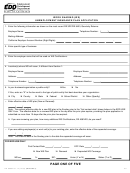

Form De 8686 - Work Sharing (Ws) - Unemployment Insurance Plan Application Page 3

ADVERTISEMENT

WORK SHARING EMPLOYER’S HOLIDAY SCHEDULE

This schedule is a required part of the Work Sharing Unemployment Insurance Plan Application

This information is necessary to process your employees’ Work Sharing (WS) payments. Work Sharing regulations

state that a holiday cannot be used as a WS day unless an employee in the same position performed compensated

services as part of an employee’s regular paid work week during the 12 months prior to the employer’s participation in

the WS Program.

Indicate whether your company was open or closed due to holidays on the days listed below during the 12 months prior

to the effective date of your WS Unemployment Insurance Plan Application. For example, if your WS Unemployment

Insurance Plan is effective in January 2003, the 12 month period would be January 2002 through December 2002.

HOLIDAY

OPEN

CLOSED

COMMENTS

†

†

New Year’s Eve

†

†

New Year’s Day

†

†

Martin Luther King Jr. Day

†

†

Lincoln’s Birthday

†

†

Washington’s Birthday

†

†

President’s Day

†

†

Cesar Chavez

†

†

Good Friday

†

†

Memorial Day

†

†

th

July 4

†

†

Labor Day

†

†

Columbus Day

†

†

Veteran’s Day

†

†

Thanksgiving

†

†

Day After Thanksgiving

†

†

Christmas Eve

†

†

Christmas

Other Holidays: Please list below

†

†

†

†

Please print or type the following information:

Date: ____/____/____

Employer Name:

California Employer Account Number (Eight Digits): ___ ___ ___ -- ___ ___ ___ ___ - ___

Contact Person:

Position or Title:

PAGE THREE OF FIVE

DE 8686 Rev. 14 (12-03) (INTERNET)

CU

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5