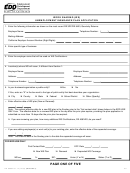

Form De 8686 - Work Sharing (Ws) - Unemployment Insurance Plan Application Page 4

ADVERTISEMENT

CERTIFYING INFORMATION

1. We understand that if we are a participating employer using the tax rate method, our reserve account will be charged in

the usual manner for benefits paid under this program. In addition, these charges may increase the employer’s

unemployment insurance contribution rate in future years.

2. We understand that if you are a participating reimbursable employer, we will be billed quarterly for the cost of benefits

paid in the same manner as they are currently billed for other unemployment insurance benefits.

3. We understand that a holiday cannot be used as a Work Sharing day unless the employee(s), in the same position,

performed compensated services as part of the employee(s) normal weekly hours of work on that holiday, during the

twelve month period prior to the employer’s participation in the Work Sharing program. Furthermore, we understand that

we are not to issue certification forms to employees that contain a holiday as the only Work Sharing day. (Section 1279.5

of the California Unemployment Insurance Code).

4. We will provide the Employment Development Department with the weekly percent of reduction in hours and wages for

each participating employee as a result of this Work Sharing program.

5. We understand that in order to be eligible, any employee must have worked at least one normal work week with no

reductions prior to issuance of certification forms for benefit payment.

6. We understand that if any employee is working for a school district and/or non-profit entity providing services to a school district,

we must provide the Employment Development Department with the dates individual employees are between successive

academic terms and/or in a recess period. Furthermore, we understand that we are not to issue certification forms to employees

for those weeks the employee is between successive terms or in a recess period, where there is reasonable assurance that the

employee will return to work. (Section 1253.3 of the California Unemployment Insurance Code).

7. We understand that a plan approved by the Employment Development Department shall expire six months after its

effective date. Expanded coverage approved to add other work unit(s) shall expire on the same date as the plan. A new

plan may be approved immediately following the expiration of the previous plan if the employer submits the new plan prior

to the expiration of the previous plan and the employer finds it necessary to provide employees with continuous coverage

under this program.

We have provided the information on this form so that our employees may participate in the Work Sharing Unemployment

Insurance program, in lieu of layoffs. We understand that failure to provide correct information, in accordance with this

certification and in accordance with the provisions of the California Unemployment Insurance Code, could result in a denial or

cancellation of this plan.

Employer Signature:

Date:

/

/

R Yes

R

Private Business: Is the signature above of a corporate officer, sole proprietor or general partner?

No

If No is checked, this WS Plan Application will be returned for the appropriate signature.

Public Entity: Is the signature above of an executive officer or person with authorization, substantiated in writing, to sign?

R Yes

R No

If No is checked, this WS Plan Application will be returned for the appropriate signature.

Please print or type the following information:

Name of person signing above:

Position or Title:

Contact Person:

Telephone Number: (

)

IF THERE IS A UNION/COLLECTIVE BARGAINING AGREEMENT

PAGE FIVE MUST BE COMPLETED

PAGE FOUR OF FIVE

DE 8686 Rev. 14 (12-03) (INTERNET)

CU

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5