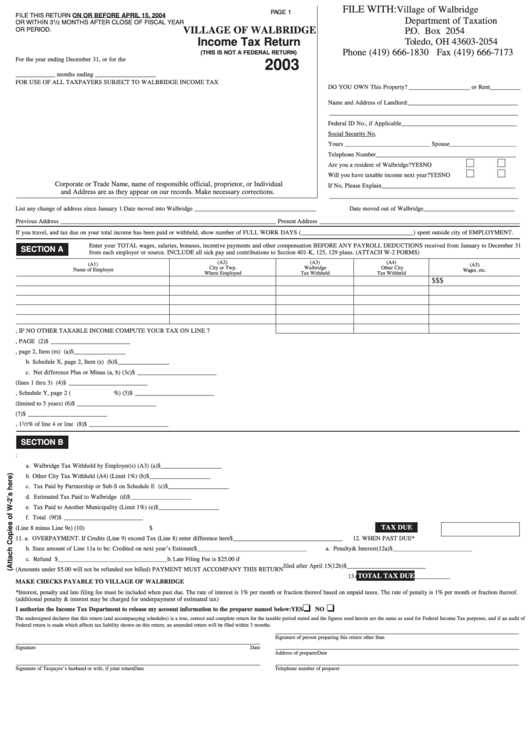

Income Tax Return - 2003 - Village Of Walbridge

ADVERTISEMENT

FILE WITH:

Village of Walbridge

PAGE 1

FILE THIS RETURN ON OR BEFORE APRIL 15, 2004

Department of Taxation

OR WITHIN 3

1

/

MONTHS AFTER CLOSE OF FISCAL YEAR

2

VILLAGE OF WALBRIDGE

OR PERIOD.

P.O. Box 2054

Income Tax Return

Toledo, OH 43603-2054

Phone (419) 666-1830 Fax (419) 666-7173

(THIS IS NOT A FEDERAL RETURN)

For the year ending December 31, or for the

2003

_____________ months ending ____________________

FOR USE OF ALL TAXPAYERS SUBJECT TO WALBRIDGE INCOME TAX

DO YOU OWN This Property? ____________________ or Rent __________

Name and Address of Landlord: ____________________________________

______________________________________________________________

Federal ID No., if Applicable ______________________________________

Social Security No.

Yours ____________________________ Spouse ______________________

Telephone Number ______________________________________________

Are you a resident of Walbridge?

YES

NO

Will you have taxable income next year?

YES

NO

Corporate or Trade Name, name of responsible official, proprietor, or Individual

If No, Please Explain ____________________________________________

and Address are as they appear on our records. Make necessary corrections.

______________________________________________________________

List any change of address since January 1: Date moved into Walbridge ________________________________________

Date moved out of Walbridge ______________________________

Previous Address _______________________________________________________________________ Present Address __________________________________________________________________

If you travel, and tax due on your total income has been paid or withheld, show number of FULL WORK DAYS (_____________________________________) spent outside city of EMPLOYMENT.

Enter your TOTAL wages, salaries, bonuses, incentive payments and other compensation BEFORE ANY PAYROLL DEDUCTIONS received from January to December 31

SECTION A

from each employer or source. INCLUDE all sick pay and contributions to Section 401-K, 125, 129 plans. (ATTACH W-2 FORMS)

(A2)

(A3)

(A4)

(A1)

(A5)

City or Twp.

Walbridge

Other City

Name of Employer

Wages, etc.

Where Employed

Tax Withheld

Tax Withheld

$

$

$

1. TOTALS, IF NO OTHER TAXABLE INCOME COMPUTE YOUR TAX ON LINE 7

2. TOTAL FROM SECTION C, PAGE 2 ................................................................................................................................................................................................ (2)

$ __________________________

3. a. Schedule X, page 2, Item (m) ADD ........................................................................................................................................ (a)

$_________________

b. Schedule X, page 2, Item (z) DEDUCT.................................................................................................................................. (b)

$_________________

c. Net difference Plus or Minus (a, b).................................................................................................................................................................................................. (3c)

$ __________________________

4. Total Income subject to Walbridge Income Tax (lines 1 thru 3) .......................................................................................................................................................... (4)

$ __________________________

5. Amount of business income only allocable to Walbridge, Schedule Y, page 2 (

%) .............................................................................................. (5)

$ __________________________

6. Less allocable Walbridge Net Loss from previous year (limited to 5 years) ...................................................................................................................................... (6)

$ __________________________

7. Income subject to Walbridge Income Tax ............................................................................................................................................................................................ (7)

$ __________________________

8. Walbridge Income Tax, 1

1

/

% of line 4 or line 7.................................................................................................................................................................................. (8)

$ __________________________

2

SECTION B

9. TAX CREDITS:

a. Walbridge Tax Withheld by Employer(s) (A3)........................................................................................................................ (a)

$____________________

b. Other City Tax Withheld (A4) (Limit 1%).............................................................................................................................. (b)

$____________________

c. Tax Paid by Partnership or Sub-S on Schedule E Income ...................................................................................................... (c)

$____________________

d. Estimated Tax Paid to Walbridge ............................................................................................................................................ (d)

$____________________

e. Tax Paid to Another Municipality (Limit 1%) ........................................................................................................................ (e)

$____________________

f. Total Credits...................................................................................................................................................................................................................................... (9f)

$ __________________________

TAX DUE

10. BALANCE (Line 8 minus Line 9e)....................................................................................................................................................................(10)

$

11. a. OVERPAYMENT. If Credits (Line 9) exceed Tax (Line 8) enter difference here $____________________________________

12. WHEN PAST DUE*

b. State amount of Line 11a to be: Credited on next year’s Estimate

$____________________________________

a. Penalty & Interest (12a)

$ __________________________

c. Refund ..............................................................................................................c. $____________________________________

b. Late Filing Fee is $25.00 if

filed after April 15 (12b)

$ __________________________

(Amounts under $5.00 will not be refunded nor billed) PAYMENT MUST ACCOMPANY THIS RETURN

TOTAL TAX DUE

13.

(13)

$ __________________________

MAKE CHECKS PAYABLE TO VILLAGE OF WALBRIDGE

*Interest, penalty and late filing fee must be included when past due. The rate of interest is 1% per month or fraction thereof based on unpaid taxes. The rate of penalty is 1% per month or fraction thereof.

(additional penalty & interest may be charged for underpayment of estimated tax)

❑

❑

I authorize the Income Tax Department to release my account information to the preparer named below: YES

NO

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated and the figures used herein are the same as used for Federal Income Tax purposes, and if an audit of

Federal return is made which affects tax liability shown on this return, an amended return will be filed within 3 months.

Signature of person preparing this return other than Taxpayer.

Date

Signature

Date

Address of preparer

Date

Signature of Taxpayer’s husband or wife, if joint return

Date

Telephone number of preparer

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2