Instructions For Form Hac - Application For The Home Accessibility Features For The Disabled Tax Credit

ADVERTISEMENT

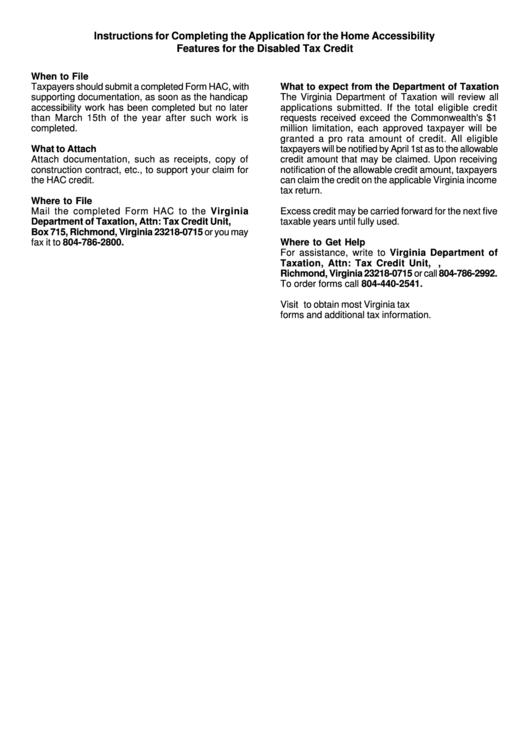

Instructions for Completing the Application for the Home Accessibility

Features for the Disabled Tax Credit

When to File

Taxpayers should submit a completed Form HAC, with

What to expect from the Department of Taxation

supporting documentation, as soon as the handicap

The Virginia Department of Taxation will review all

accessibility work has been completed but no later

applications submitted. If the total eligible credit

than March 15th of the year after such work is

requests received exceed the Commonwealth's $1

completed.

million limitation, each approved taxpayer will be

granted a pro rata amount of credit. All eligible

What to Attach

taxpayers will be notified by April 1st as to the allowable

Attach documentation, such as receipts, copy of

credit amount that may be claimed. Upon receiving

construction contract, etc., to support your claim for

notification of the allowable credit amount, taxpayers

the HAC credit.

can claim the credit on the applicable Virginia income

tax return.

Where to File

Mail the completed Form HAC to the Virginia

Excess credit may be carried forward for the next five

Department of Taxation, Attn: Tax Credit Unit, P.O.

taxable years until fully used.

Box 715, Richmond, Virginia 23218-0715 or you may

fax it to 804-786-2800.

Where to Get Help

For assistance, write to Virginia Department of

Taxation, Attn: Tax Credit Unit, P.O. Box 715,

Richmond, Virginia 23218-0715 or call 804-786-2992.

To order forms call 804-440-2541.

Visit to obtain most Virginia tax

forms and additional tax information.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1