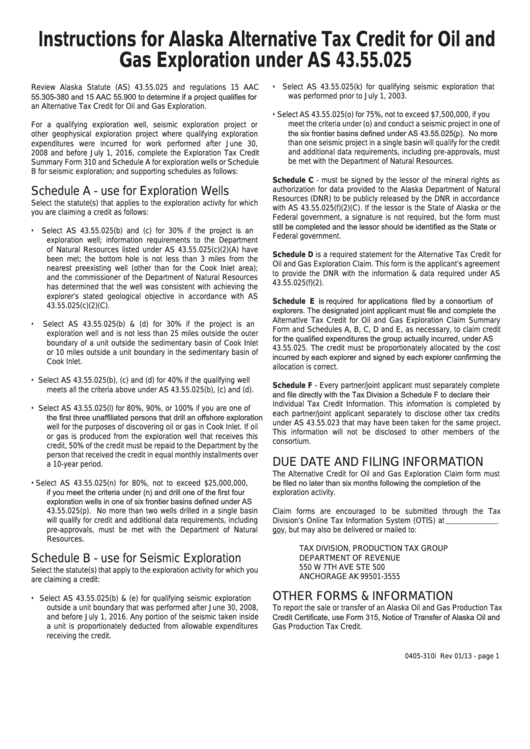

Instructions For Alaska Alternative Tax Credit For Oil And Gas Exploration Under As 43.55.025

ADVERTISEMENT

Instructions for Alaska Alternative Tax Credit for Oil and

Gas Exploration under AS 43.55.025

•

Select AS 43.55.025(k) for qualifying seismic exploration that

Review Alaska Statute (AS) 43.55.025 and regulations 15 AAC

55.305-380 and 15 AAC 55.900 to determine if a project qualifies for

was performed prior to July 1, 2003.

an Alternative Tax Credit for Oil and Gas Exploration.

•

Select AS 43.55.025(o) for 75%, not to exceed $7,500,000, if you

meet the criteria under (o) and conduct a seismic project in one of

For a qualifying exploration well, seismic exploration project or

the six frontier basins defined under AS 43.55.025(p). No more

other geophysical exploration project where qualifying exploration

than one seismic project in a single basin will qualify for the credit

expenditures were incurred for work performed after June 30,

and additional data requirements, including pre-approvals, must

2008 and before July 1, 2016, complete the Exploration Tax Credit

be met with the Department of Natural Resources.

Summary Form 310 and Schedule A for exploration wells or Schedule

B for seismic exploration; and supporting schedules as follows:

Schedule C - must be signed by the lessor of the mineral rights as

Schedule A - use for Exploration Wells

authorization for data provided to the Alaska Department of Natural

Resources (DNR) to be publicly released by the DNR in accordance

Select the statute(s) that applies to the exploration activity for which

with AS 43.55.025(f)(2)(C). If the lessor is the State of Alaska or the

you are claiming a credit as follows:

Federal government, a signature is not required, but the form must

still be completed and the lessor should be identified as the State or

•

Select AS 43.55.025(b) and (c) for 30% if the project is an

Federal government.

exploration well; information requirements to the Department

of Natural Resources listed under AS 43.55.025(c)(2)(A) have

Schedule D is a required statement for the Alternative Tax Credit for

been met; the bottom hole is not less than 3 miles from the

Oil and Gas Exploration Claim. This form is the applicant’s agreement

nearest preexisting well (other than for the Cook Inlet area);

to provide the DNR with the information & data required under AS

and the commissioner of the Department of Natural Resources

43.55.025(f)(2).

has determined that the well was consistent with achieving the

explorer’s stated geological objective in accordance with AS

Schedule E is required for applications filed by a consortium of

43.55.025(c)(2)(C).

explorers. The designated joint applicant must file and complete the

Alternative Tax Credit for Oil and Gas Exploration Claim Summary

•

Select AS 43.55.025(b) & (d) for 30% if the project is an

Form and Schedules A, B, C, D and E, as necessary, to claim credit

exploration well and is not less than 25 miles outside the outer

for the qualified expenditures the group actually incurred, under AS

boundary of a unit outside the sedimentary basin of Cook Inlet

43.55.025. The credit must be proportionately allocated by the cost

or 10 miles outside a unit boundary in the sedimentary basin of

incurred by each explorer and signed by each explorer confirming the

Cook Inlet.

allocation is correct.

•

Select AS 43.55.025(b), (c) and (d) for 40% if the qualifying well

Schedule F - Every partner/joint applicant must separately complete

meets all the criteria above under AS 43.55.025(b), (c) and (d).

and file directly with the Tax Division a Schedule F to declare their

Individual Tax Credit Information. This information is completed by

•

Select AS 43.55.025(l) for 80%, 90%, or 100% if you are one of

each partner/joint applicant separately to disclose other tax credits

the first three unaffiliated persons that drill an offshore exploration

under AS 43.55.023 that may have been taken for the same project.

well for the purposes of discovering oil or gas in Cook Inlet. If oil

This information will not be disclosed to other members of the

or gas is produced from the exploration well that receives this

consortium.

credit, 50% of the credit must be repaid to the Department by the

person that received the credit in equal monthly installments over

DUE DATE AND FILING INFORMATION

a 10-year period.

The Alternative Credit for Oil and Gas Exploration Claim form must

be filed no later than six months following the completion of the

•

Select AS 43.55.025(n) for 80%, not to exceed $25,000,000,

if you meet the criteria under (n) and drill one of the first four

exploration activity.

exploration wells in one of six frontier basins defined under AS

43.55.025(p). No more than two wells drilled in a single basin

Claim forms are encouraged to be submitted through the Tax

will qualify for credit and additional data requirements, including

Division’s Online Tax Information System (OTIS) at

pre-approvals, must be met with the Department of Natural

gov, but may also be delivered or mailed to:

Resources.

TAX DIVISION, PRODUCTION TAX GROUP

Schedule B - use for Seismic Exploration

DEPARTMENT OF REVENUE

550 W 7TH AVE STE 500

Select the statute(s) that apply to the exploration activity for which you

ANCHORAGE AK 99501-3555

are claiming a credit:

OTHER FORMS & INFORMATION

•

Select AS 43.55.025(b) & (e) for qualifying seismic exploration

outside a unit boundary that was performed after June 30, 2008,

To report the sale or transfer of an Alaska Oil and Gas Production Tax

Credit Certificate, use Form 315, Notice of Transfer of Alaska Oil and

and before July 1, 2016. Any portion of the seismic taken inside

a unit is proportionately deducted from allowable expenditures

Gas Production Tax Credit.

receiving the credit.

0405-310i Rev 01/13 - page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2