Montana Form Ext-10 - Extension Payment Worksheet - 2010

ADVERTISEMENT

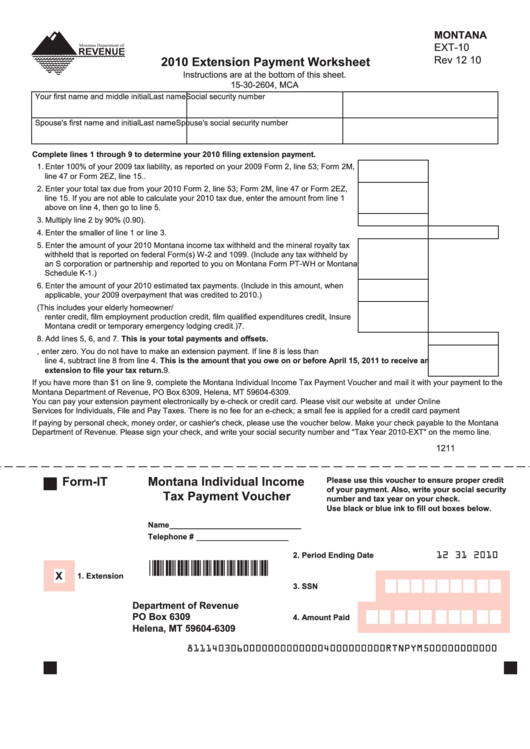

MONTANA

EXT-10

Rev 12 10

2010 Extension Payment Worksheet

Instructions are at the bottom of this sheet.

15-30-2604, MCA

Your first name and middle initial

Last name

Social security number

Spouse's first name and initial

Last name

Spouse's social security number

Complete lines 1 through 9 to determine your 2010 filing extension payment.

1. Enter 100% of your 2009 tax liability, as reported on your 2009 Form 2, line 53; Form 2M,

line 47 or Form 2EZ, line 15.. ..............................................................................................1.

2. Enter your total tax due from your 2010 Form 2, line 53; Form 2M, line 47 or Form 2EZ,

line 15. If you are not able to calculate your 2010 tax due, enter the amount from line 1

above on line 4, then go to line 5.........................................................................................2.

3. Multiply line 2 by 90% (0.90). ..............................................................................................3.

4. Enter the smaller of line 1 or line 3. .....................................................................................................................4.

5. Enter the amount of your 2010 Montana income tax withheld and the mineral royalty tax

withheld that is reported on federal Form(s) W-2 and 1099. (Include any tax withheld by

an S corporation or partnership and reported to you on Montana Form PT-WH or Montana

Schedule K-1.) .....................................................................................................................5.

6. Enter the amount of your 2010 estimated tax payments. (Include in this amount, when

applicable, your 2009 overpayment that was credited to 2010.) .........................................6.

7. Enter the amount of your 2010 refundable credits. (This includes your elderly homeowner/

renter credit, film employment production credit, film qualified expenditures credit, Insure

Montana credit or temporary emergency lodging credit.) ....................................................7.

8. Add lines 5, 6, and 7. This is your total payments and offsets. ......................................................................8.

9. If line 8 is greater than line 4, enter zero. You do not have to make an extension payment. If line 8 is less than

line 4, subtract line 8 from line 4. This is the amount that you owe on or before April 15, 2011 to receive an

extension to file your tax return. ......................................................................................................................9.

If you have more than $1 on line 9, complete the Montana Individual Income Tax Payment Voucher and mail it with your payment to the

Montana Department of Revenue, PO Box 6309, Helena, MT 59604-6309.

You can pay your extension payment electronically by e-check or credit card. Please visit our website at revenue.mt.gov under Online

Services for Individuals, File and Pay Taxes. There is no fee for an e-check; a small fee is applied for a credit card payment

If paying by personal check, money order, or cashier's check, please use the voucher below. Make your check payable to the Montana

Department of Revenue. Please sign your check, and write your social security number and "Tax Year 2010-EXT" on the memo line.

1211

Form-IT

Montana Individual Income

Please use this voucher to ensure proper credit

of your payment. Also, write your social security

Tax Payment Voucher

number and tax year on your check.

Use black or blue ink to fill out boxes below.

Name ______________________________

Telephone # _____________________

12 31 2010

2. Period Ending Date

*00110101*

X

1. Extension

3. SSN

Department of Revenue

PO Box 6309

4. Amount Paid

Helena, MT 59604-6309

81114030600000000000004000000000RTNPYM500000000000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2