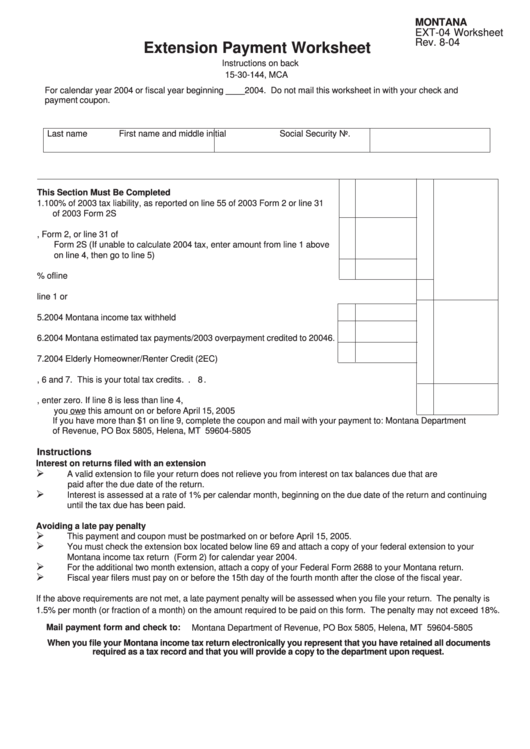

MONTANA

EXT-04 Worksheet

Rev. 8-04

Extension Payment Worksheet

Instructions on back

15-30-144, MCA

For calendar year 2004 or fiscal year beginning ____2004. Do not mail this worksheet in with your check and

payment coupon.

Last name

First name and middle initial

Social Security No.

This Section Must Be Completed

1. 100% of 2003 tax liability, as reported on line 55 of 2003 Form 2 or line 31

of 2003 Form 2S ........................................................................................... 1.

2. Total tax liability for 2004 as entered on line 54, Form 2, or line 31 of

Form 2S (If unable to calculate 2004 tax, enter amount from line 1 above

on line 4, then go to line 5) ............................................................................ 2.

3. Enter 90% of line 2 ........................................................................................ 3.

4. Enter the lesser of line 1 or 3 ........................................................................................................ 4.

5. 2004 Montana income tax withheld ............................................................... 5.

6. 2004 Montana estimated tax payments/2003 overpayment credited to 2004 6.

7. 2004 Elderly Homeowner/Renter Credit (2EC) .............................................. 7.

8. Add lines 5, 6 and 7. This is your total tax credits. ........................................................................ 8.

9. Subtract line 8 from line 4 - If line 8 is greater than line 4, enter zero. If line 8 is less than line 4,

you owe this amount on or before April 15, 2005 .......................................................................... 9.

If you have more than $1 on line 9, complete the coupon and mail with your payment to: Montana Department

of Revenue, PO Box 5805, Helena, MT 59604-5805

Instructions

Interest on returns filed with an extension

A valid extension to file your return does not relieve you from interest on tax balances due that are

paid after the due date of the return.

Interest is assessed at a rate of 1% per calendar month, beginning on the due date of the return and continuing

until the tax due has been paid.

Avoiding a late pay penalty

This payment and coupon must be postmarked on or before April 15, 2005.

You must check the extension box located below line 69 and attach a copy of your federal extension to your

Montana income tax return (Form 2) for calendar year 2004.

For the additional two month extension, attach a copy of your Federal Form 2688 to your Montana return.

Fiscal year filers must pay on or before the 15th day of the fourth month after the close of the fiscal year.

If the above requirements are not met, a late payment penalty will be assessed when you file your return. The penalty is

1.5% per month (or fraction of a month) on the amount required to be paid on this form. The penalty may not exceed 18%.

Mail payment form and check to:

Montana Department of Revenue, PO Box 5805, Helena, MT 59604-5805

When you file your Montana income tax return electronically you represent that you have retained all documents

required as a tax record and that you will provide a copy to the department upon request.

1

1 2

2