(R4 / 9-12)

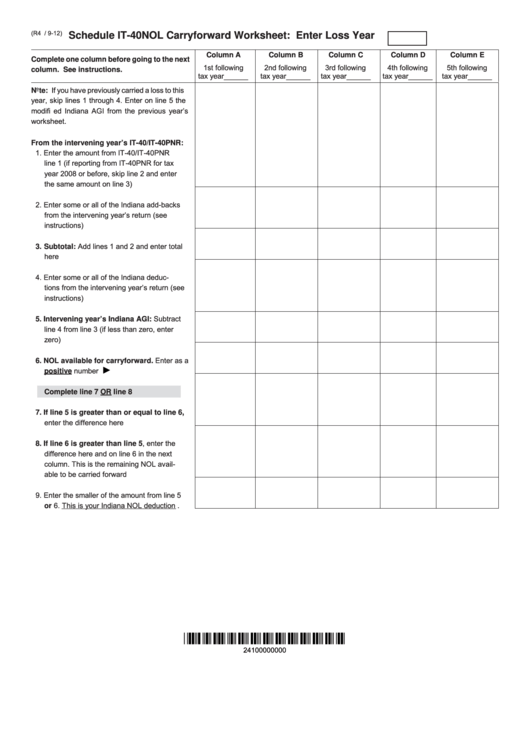

Schedule IT-40NOL Carryforward Worksheet: Enter Loss Year

Column A

Column B

Column C

Column D

Column E

Complete one column before going to the next

1st following

2nd following

3rd following

4th following

5th following

column. See instructions.

tax year______

tax year______

tax year______

tax year______

tax year______

Note: If you have previously carried a loss to this

year, skip lines 1 through 4. Enter on line 5 the

modifi ed Indiana AGI from the previous year’s

worksheet.

From the intervening year’s IT-40/IT-40PNR:

1. Enter the amount from IT-40/IT-40PNR

line 1 (if reporting from IT-40PNR for tax

year 2008 or before, skip line 2 and enter

the same amount on line 3) .....................

2. Enter some or all of the Indiana add-backs

from the intervening year’s return (see

instructions) ..............................................

3. Subtotal: Add lines 1 and 2 and enter total

here ..........................................................

4. Enter some or all of the Indiana deduc-

tions from the intervening year’s return (see

instructions) ..............................................

5. Intervening year’s Indiana AGI: Subtract

line 4 from line 3 (if less than zero, enter

zero) .........................................................

6. NOL available for carryforward. Enter as a

►

positive number ......................................

Complete line 7 OR line 8

7. If line 5 is greater than or equal to line 6,

enter the difference here .........................

8. If line 6 is greater than line 5, enter the

difference here and on line 6 in the next

column. This is the remaining NOL avail-

able to be carried forward ........................

9. Enter the smaller of the amount from line 5

or 6. This is your Indiana NOL deduction .

24100000000

1

1 2

2 3

3 4

4