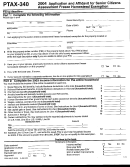

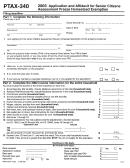

Form Pt-283a - Application And Questionnaire For Current Use Assessment Of Bona Fide Agricultural Property Page 2

ADVERTISEMENT

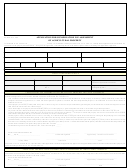

CURRENT USE ASSESSMENT QUESTIONNAIRE – PT283A

ALL APPLICANTS, other than single titled owners, must list below each individual’s name that owns a beneficial interest in the property

described in this application, the percentage interest of each, the relationship of each (if the applicant is a family farm entity), and all other

information applicable to this application.

Counties where you

Each owner’s percent

Each Person’s Name

Relationship

Percent interest

own interest in

interest owned and

having any beneficial interest in the property

(complete only

owned in

property under other

number of acres

described in this application

if application is

property in

this

covenants and total

owned by each under

(If this form does not contain sufficient lines to list all

for a family

application

acres in other

other covenants

owners, please attach list providing all information

farm entity)

only

conservation use

requested for each individual)

covenants

Total

Percent

No. of

County

Acres

Interest

Acres

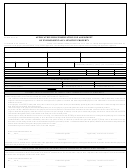

Check Appropriate Ownership Type:

[ ] One or more natural or naturalized citizens.

[ ] An estate of which the devisees or heirs are one or more natural or naturalized citizens.

[ ] A trust of which the beneficiaries are one or more natural or naturalized citizens.

[ ] A family owned farm entity (e.g., a family corporation, family partnership, family general partnership, family limited partnership, family

limited corporation or family limited liability company. Percent (%) of gross income from bona fide conservation uses. ______(including

earnings on investments directly related to past or future bona fide conservation uses, within this state within the year immediately

preceding the year in which eligibility is sought (include supporting tax records); provided, however, that in the case of a newly formed

family farm entity, an estimate of the income of such entity may be used to determine its eligibility (include supporting estimate records.)

[ ] Nonprofit conservation organization designated as a 501(c)(3) organization under the Internal Revenue Code. (Provide copy of IRS

determination letter/charter with application.)

[ ] Bona fide club organized for pleasure, recreation, and other nonprofitable purposes pursuant to Section 501(c)(7) of the Internal Revenue

Code. (Provide copy of IRS determination letter/charter with application.)

Check All Bona fide uses that apply and the percentage use, as they relate to the property described in this application.

[ ] Raising, harvesting, or storing crops %______

[ ] Feeding, breeding, or managing livestock or poultry %______

[ ] Producing plants, trees, fowl, or animals (including the production of fish or wildlife) %______

[ ] Wildlife habitat of not less than ten (10) acres of wildlife habitat (either in its natural state or under management; no form of commercial

fishing or fish production shall be considered a type of agriculture); %_____ (see board of tax assessors for appropriate documentation in

accordance with O.C.G.A. Section 48-5-7.4(b)(2 )

[ ] Production of aquaculture, horticulture, floriculture, forestry, dairy, livestock, poultry, and apiarian products %______

[ ] Other

( ) Yes ( ) No

Is this property or any portion thereof, currently being leased? (If yes, list the name of the person or entity and briefly explain how

the property is being used by the lessee, as well as the percentage of the property leased.)

( ) Yes ( ) No

Are there other real property improvements located on this property other than the storage and processing buildings listed on the

front of this application? If yes, briefly list and described these real property improvements.

( ) Yes ( ) No

Are there any restrictive covenants currently affecting the property described in this application. If yes, please explain.

( ) Yes ( ) No

Are there any deed restriction on this property? If yes, please list the restrictions.

( ) Yes ( ) No

Does the current zoning on this property allow agricultural use? If no, please explain.

( ) Yes ( ) No

Is there any type business operated on this property? If yes please indicate business name & type of business.

•

If this application is for property that is less than 10 acres in size, a taxpayer must submit additional relevant records providing proof of bona

fide agricultural use.

•

Although not required, the applicant(s) for a property having more than 10 acres may wish to provide additional information to assist the board

of assessors in making their determination. This information may include:

Plans or programs for the production of agricultural and timber products.

o

Evidence of participation in a government subsidy program for crops or timber.

o

o

Receipts that substantiate a bona fide conservation use, such as receipts for feed, equipment, etc.

Income tax records, such as copies of a previously filed Federal Schedule F or the appropriate entity return (e.g., Federal Form 1065,

o

1120, etc.)

•

The Board of Tax Assessors can only deny an application if the use of the property does not meet the definition of bona fide agricultural

property or if the ownership of the property is not in compliance with O.C.G.A. § 48-5-7.4.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2