Minnesota Property Tax Refund Forms And Instructions - 2006 Page 16

ADVERTISEMENT

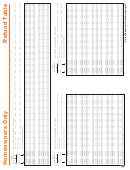

Renters Only

Refund Table

and line of Form M1PR is at least:

If line , Form M1PR is:

$1,775

1,800

1,825

1,850

1,875

1,900

1,925

1,950

1,975

2,000

at

but less

but less than:

least

than

$1,800

1,825

1,850

1,875

1,900

1,925

1,950

1,975

2,000

& over

your property tax refund is:

– – –

$11,240

1,400

1,400

1,400

1,400

1,400

1,400

1,400

1,400

1,400

1,400

$11,240

12,650

1,387

1,400

1,400

1,400

1,400

1,400

1,400

1,400

1,400

1,400

12,650

14,050

1,361

1,382

1,400

1,400

1,400

1,400

1,400

1,400

1,400

1,400

14,050

15,450

1,265

1,285

1,305

1,325

1,345

1,365

1,385

1,400

1,400

1,400

15,450

16,860

1,236

1,256

1,276

1,296

1,316

1,336

1,356

1,376

1,396

1,400

16,860

18,270

1,219

1,239

1,259

1,279

1,299

1,319

1,339

1,359

1,379

*

18,270

19,670

1,187

1,207

1,227

1,247

1,267

1,287

1,307

1,327

1,347

*

19,670

21,060

1,081

1,100

1,118

1,137

1,156

1,175

1,193

1,212

1,231

*

21,060

22,470

1,047

1,066

1,084

1,103

1,122

1,141

1,159

1,178

1,197

*

22,470

23,880

1,028

1,047

1,065

1,084

1,103

1,122

1,140

1,159

1,178

*

23,880

25,280

924

942

959

977

994

1,012

1,029

1,047

1,064

*

25,280

26,680

888

905

923

940

958

975

993

1,010

1,028

*

26,680

28,090

830

847

865

882

900

917

935

952

970

*

28,090

29,490

768

785

803

820

838

855

873

890

908

*

29,490

30,900

652

668

684

700

717

733

749

765

782

*

30,900

32,310

607

623

640

656

672

688

705

721

737

*

32,310

33,710

561

577

594

610

626

642

659

675

691

*

33,710

35,110

474

489

504

519

534

549

564

579

594

*

35,110

36,530

428

443

458

473

488

503

518

533

548

*

36,530

37,930

380

395

410

425

440

455

470

485

500

*

37,930

39,330

331

346

361

376

391

406

421

436

451

*

39,330

40,730

257

270

284

298

312

325

339

353

367

*

40,730

42,140

208

222

236

250

263

277

291

305

318

*

42,140

43,550

158

172

186

200

213

227

241

255

268

*

43,550

44,950

119

132

144

157

169

182

194

207

219

*

44,950

46,360

95

107

120

132

145

157

170

182

195

*

46,360

47,760

70

83

95

108

120

133

145

158

170

*

47,760

49,160

46

58

71

83

96

108

121

133

140

*

49,160

& over

0

0

0

0

0

0

0

0

0

0

* Use the Renter’s Worksheet below.

Renter’s Worksheet

For household incomes of $16,860 or more with prop-

Table for Renter’s Worksheet

erty tax of $2,000 or more

If step 2 is

1 Amount from line 9 of Form M1PR . . . . . . . 1

but less

enter on

enter on

enter on

at least:

than:

step 3

step 6

step 8

Total household income from

line 8 of Form M1PR . . . . . . . . . . . . . . . .

$16,860

$18,270

0.015

0.80

1,400

18,270

19,670

0.016

0.80

1,400

Enter the decimal number for this step

19,670

21,060

0.017

0.75

1,400

from the table at right . . . . . . . . . . . . . . .

21,060

23,880

0.018

0.75

1,400

Multiply step 2 by step 3 . . . . . . . . . . . . .

23,880

25,280

0.019

0.70

1,400

5 Subtract step 4 from step 1 (if result is

25,280

26,680

0.020

0.70

1,400

zero or less, stop here; you are not eligible

26,680

28,090

0.022

0.70

1,400

28,090

29,490

0.024

0.70

1,400

for a refund) . . . . . . . . . . . . . . . . . . . . . . 5

29,490

30,900

0.026

0.65

1,400

6 Enter the decimal number for this step

30,900

32,310

0.027

0.65

1,400

from the table at right . . . . . . . . . . . . . . . 6

32,310

33,710

0.028

0.65

1,400

7 Multiply step 5 by step 6 . . . . . . . . . . . . . 7

33,710

35,110

0.029

0.60

1,400

35,110

36,530

0.030

0.60

1,400

Enter the amount for this step

36,530

37,930

0.031

0.60

1,400

from the table at right . . . . . . . . . . . . . . .

37,930

39,330

0.032

0.60

1,400

Enter the amount from step 7 or step 8,

39,330

40,730

0.033

0.55

1,270

whichever is less. Also enter this amount

40,730

42,140

0.034

0.55

1,130

on line 10 of Form M1PR, or if you are

42,140

43,550

0.035

0.55

980

completing Schedule 2, enter on line 37 . .

43,550

44,950

0.035

0.50

850

44,950

46,360

0.035

0.50

710

46,360

47,760

0.035

0.50

420

47,760

49,160

0.035

0.50

140

16

49,160

& over

not eligible

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24