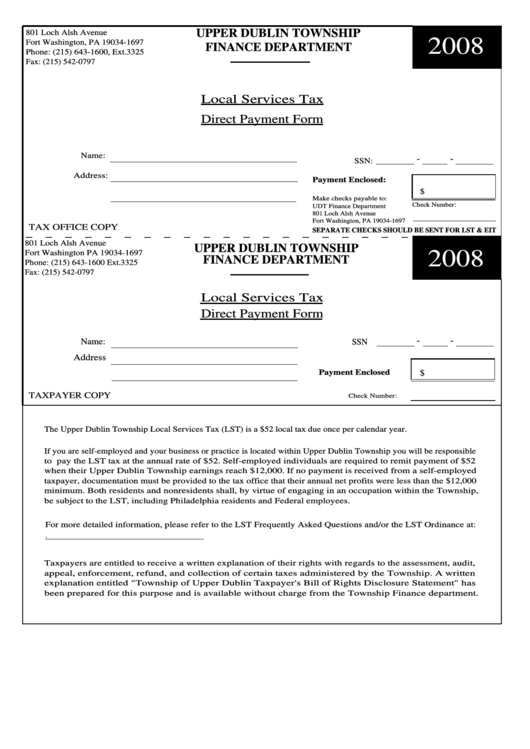

UPPER DUBLIN TOWNSHIP

801 Loch Alsh Avenue

2008

Fort Washington, PA 19034-1697

FINANCE DEPARTMENT

Phone: (215) 643-1600, Ext.3325

Fax: (215) 542-0797

Local Services Tax

Direct Payment Form

Name:

-

-

SSN:

Address:

Payment Enclosed:

$

Make checks payable to:

Check Number:

UDT Finance Department

801 Loch Alsh Avenue

Fort Washington, PA 19034-1697

TAX OFFICE COPY

SEPARATE CHECKS SHOULD BE SENT FOR LST & EIT

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

801 Loch Alsh Avenue

UPPER DUBLIN TOWNSHIP

2008

Fort Washington PA 19034-1697

FINANCE DEPARTMENT

Phone: (215) 643-1600 Ext.3325

Fax: (215) 542-0797

Local Services Tax

Direct Payment Form

-

-

Name:

SSN

Address

Payment Enclosed

$

TAXPAYER COPY

Check Number:

The Upper Dublin Township Local Services Tax (LST) is a $52 local tax due once per calendar year.

If you are self-employed and your business or practice is located within Upper Dublin Township you will be responsible

to pay the LST tax at the annual rate of $52. Self-employed individuals are required to remit payment of $52

when their Upper Dublin Township earnings reach $12,000. If no payment is received from a self-employed

taxpayer, documentation must be provided to the tax office that their annual net profits were less than the $12,000

minimum. Both residents and nonresidents shall, by virtue of engaging in an occupation within the Township,

be subject to the LST, including Philadelphia residents and Federal employees.

For more detailed information, please refer to the LST Frequently Asked Questions and/or the LST Ordinance at:

/finance/documents.aspx.

Taxpayers are entitled to receive a written explanation of their rights with regards to the assessment, audit,

appeal, enforcement, refund, and collection of certain taxes administered by the Township. A written

explanation entitled "Township of Upper Dublin Taxpayer's Bill of Rights Disclosure Statement" has

been prepared for this purpose and is available without charge from the Township Finance department.

1

1