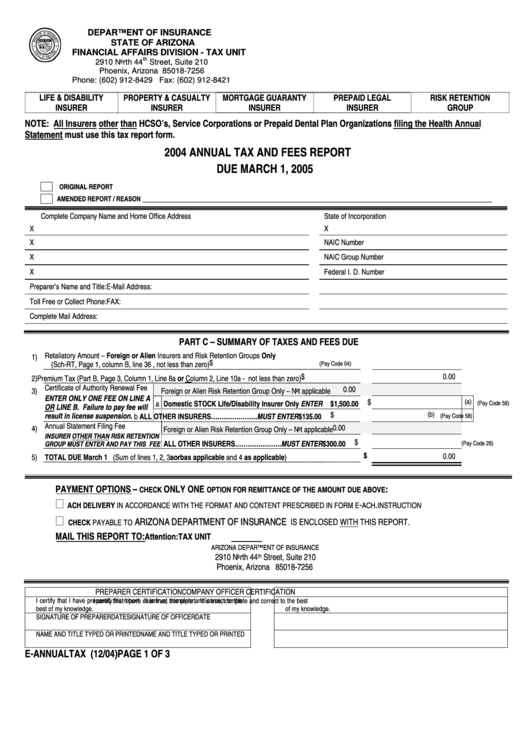

DEPARTMENT OF INSURANCE

STATE OF ARIZONA

FINANCIAL AFFAIRS DIVISION - TAX UNIT

th

2910 North 44

Street, Suite 210

Phoenix, Arizona 85018-7256

Phone: (602) 912-8429 Fax: (602) 912-8421

LIFE & DISABILITY

PROPERTY & CASUALTY

MORTGAGE GUARANTY

PREPAID LEGAL

RISK RETENTION

INSURER

INSURER

INSURER

INSURER

GROUP

NOTE: All Insurers other than HCSO’s, Service Corporations or Prepaid Dental Plan Organizations filing the Health Annual

Statement must use this tax report form.

2004 ANNUAL TAX AND FEES REPORT

DUE MARCH 1, 2005

ORIGINAL REPORT

__________________________________________________________________________________________

AMENDED REPORT / REASON

Complete Company Name and Home Office Address

State of Incorporation

X

X

X

NAIC Number

X

NAIC Group Number

X

Federal I. D. Number

Preparer’s Name and Title:

E-Mail Address:

Toll Free or Collect Phone:

FAX:

Complete Mail Address:

PART C – SUMMARY OF TAXES AND FEES DUE

1) Retaliatory Amount – Foreign or Alien Insurers and Risk Retention Groups Only

$

(Sch-RT, Page 1, column B, line 36 , not less than zero)

(Pay Code 04)

0.00

$

2) Premium Tax (Part B, Page 3, Column 1, Line 8a or Column 2, Line 10a - not less than zero)

Certificate of Authority Renewal Fee

0.00

3)

Foreign or Alien Risk Retention Group Only – Not applicable

ENTER ONLY ONE FEE ON LINE A

$

(a)

a Domestic STOCK Life/Disability Insurer Only ENTER $1,500.00

(Pay Code 56)

OR LINE B. Failure to pay fee will

$

(b)

result in license suspension.

b ALL OTHER INSURERS………………….MUST ENTER

$135.00

(Pay Code 58)

4) Annual Statement Filing Fee

0.00

Foreign or Alien Risk Retention Group Only – Not applicable

INSURER OTHER THAN RISK RETENTION

$

ALL OTHER INSURERS………………….MUST ENTER

$300.00

(Pay Code 28)

GROUP MUST ENTER AND PAY THIS FEE

0.00

$

5) TOTAL DUE March 1 (Sum of lines 1, 2, 3a or b as applicable and 4 as applicable)

PAYMENT OPTIONS –

ONLY ONE

:

CHECK

OPTION FOR REMITTANCE OF THE AMOUNT DUE ABOVE

-

.

ACH DELIVERY IN ACCORDANCE WITH THE FORMAT AND CONTENT PRESCRIBED IN FORM E

ACH

INSTRUCTION

A

R

I

Z

O

N

A

D

E

P

A

R

T

M

E

N

T

O

F

I

N

S

U

R

A

N

C

E

A

R

I

Z

O

N

A

D

E

P

A

R

T

M

E

N

T

O

F

I

N

S

U

R

A

N

C

E

IS ENCLOSED WITH THIS REPORT.

CHECK PAYABLE TO

MAIL THIS REPORT TO:

Attention: TAX UNIT

ARIZONA DEPARTMENT OF INSURANCE

2910 North 44

Street, Suite 210

th

Phoenix, Arizona 85018-7256

PREPARER CERTIFICATION

COMPANY OFFICER CERTIFICATION

I certify that I have prepared this report. It is true, complete and correct to the

I certify that I have examined this report. It is true, complete and correct to the best

best of my knowledge.

of my knowledge.

SIGNATURE OF PREPARER

DATE

SIGNATURE OF OFFICER

DATE

NAME AND TITLE TYPED OR PRINTED

NAME AND TITLE TYPED OR PRINTED

E-ANNUALTAX (12/04)

PAGE 1 OF 3

1

1 2

2 3

3