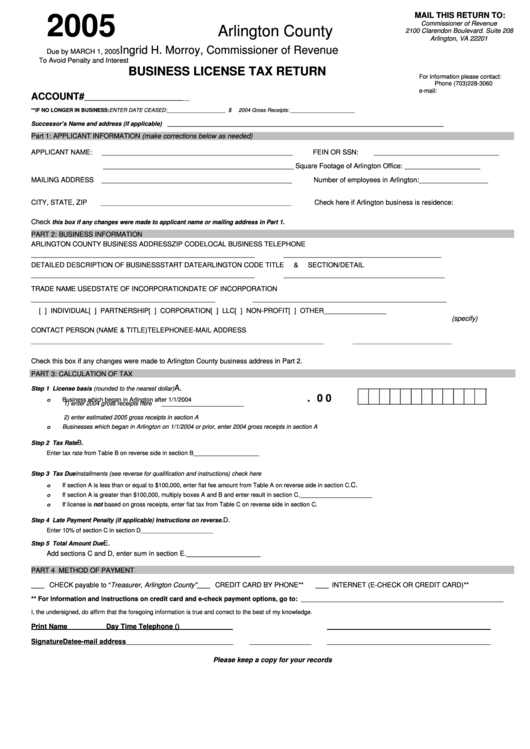

Business License Tax Return Form 2005 - State Of Virginia

ADVERTISEMENT

MAIL THIS RETURN TO:

2005

Commissioner of Revenue

Arlington County

2100 Clarendon Boulevard. Suite 208

Arlington, VA 22201

Ingrid H. Morroy, Commissioner of Revenue

Due by MARCH 1, 2005

To Avoid Penalty and Interest

BUSINESS LICENSE TAX RETURN

For information please contact:

Phone (703)228-3060

e-mail: business@arlingtonva.us

ACCOUNT#

________________________________

**IF NO LONGER IN BUSINESS:

ENTER DATE CEASED:____________________ $

2004 Gross Receipts: ______________________

Successor’s Name and address (if applicable) ____________________________________________________________________________________

Part 1: APPLICANT INFORMATION (make corrections below as needed)

APPLICANT NAME:

FEIN OR SSN:

__________________________________________________________

______________________________________

Square Footage of Arlington Office:

__________________________________________________________

_______________________

MAILING ADDRESS

Number of employees in Arlington:

__________________________________________________________

_____________________

CITY, STATE, ZIP

Check here if Arlington business is residence:

__________________________________________________________

Check

this box if any changes were made to applicant name or mailing address in Part 1.

PART 2: BUSINESS INFORMATION

ARLINGTON COUNTY BUSINESS ADDRESS

ZIP CODE

LOCAL BUSINESS TELEPHONE

________________________________________________________

____________

________________________________________________

DETAILED DESCRIPTION OF BUSINESS

START DATE

ARLINGTON CODE TITLE

&

SECTION/DETAIL

________________________________________________________

____________

_________________________________________________

TRADE NAME USED

STATE OF INCORPORATION

DATE OF INCORPORATION

________________________________________________________

______________________________

_____________________________

[ ] INDIVIDUAL

[ ] PARTNERSHIP

[ ] CORPORATION

[ ] LLC

[ ] NON-PROFIT

[ ] OTHER

___________________

(specify)

CONTACT PERSON (NAME & TITLE)

TELEPHONE

E-MAIL ADDRESS

________________________________________________________

_________________________________

______________________________

Check this box if any changes were made to Arlington County business address in Part 2.

PART 3: CALCULATION OF TAX

A.

Step 1 License basis (rounded to the nearest dollar)

. 0 0

Business which began in Arlington after 1/1/2004

o

1) enter 2004 gross receipts here

_________________________

2) enter estimated 2005 gross receipts in section A

Businesses which began in Arlington on 1/1/2004 or prior, enter 2004 gross receipts in section A

o

B.

Step 2 Tax Rate

Enter tax rate from Table B on reverse side in section B

____________________

Step 3 Tax Due

Installments (see reverse for qualification and instructions) check here

C.

If section A is less than or equal to $100,000, enter flat fee amount from Table A on reverse side in section C.

o

If section A is greater than $100,000, multiply boxes A and B and enter result in section C.

______________________

o

If license is not based on gross receipts, enter flat tax from Table C on reverse side in section C.

o

D.

Step 4 Late Payment Penalty (if applicable) Instructions on reverse.

Enter 10% of section C in section D

______________________

E.

Step 5 Total Amount Due

Add sections C and D, enter sum in section E.

___________________

PART 4 METHOD OF PAYMENT

CHECK payable to “Treasurer, Arlington County”

CREDIT CARD BY PHONE**

INTERNET (E-CHECK OR CREDIT CARD)**

____

____

____

** For information and instructions on credit card and e-check payment options, go to:

I, the undersigned, do affirm that the foregoing information is true and correct to the best of my knowledge.

Print Name

Day Time Telephone (

)

Signature

Date

e-mail address

Please keep a copy for your records

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1