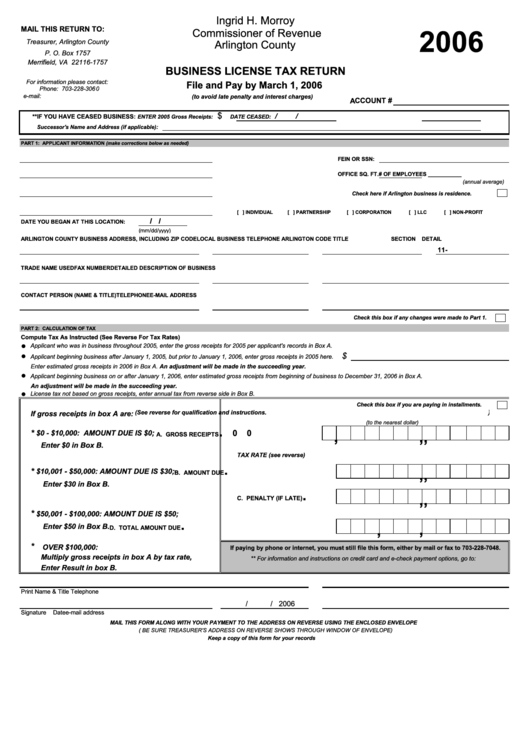

Business License Tax Return Form - Arlington County - 2006

ADVERTISEMENT

Ingrid H. Morroy

MAIL THIS RETURN TO:

2006

Commissioner of Revenue

Treasurer, Arlington County

Arlington County

P. O. Box 1757

Merrifield, VA 22116-1757

BUSINESS LICENSE TAX RETURN

For information please contact:

File and Pay by March 1, 2006

Phone: 703-228-3060

e-mail: business@arlingtonva.us

(to avoid late penalty and interest charges)

ACCOUNT #

$

/

/

**IF YOU HAVE CEASED BUSINESS:

ENTER 2005 Gross Receipts:

DATE CEASED:

Successor's Name and Address (if applicable):

PART 1: APPLICANT INFORMATION (make corrections below as needed)

FEIN OR SSN:

OFFICE SQ. FT.

# OF EMPLOYEES ___________

(annual average)

Check here if Arlington business is residence.

[ ] INDIVIDUAL

[ ] PARTNERSHIP

[ ] CORPORATION

[ ] LLC

[ ] NON-PROFIT

/ /

DATE YOU BEGAN AT THIS LOCATION:

(mm/dd/yyyy)

ARLINGTON COUNTY BUSINESS ADDRESS, INCLUDING ZIP CODE

LOCAL BUSINESS TELEPHONE

ARLINGTON CODE TITLE

SECTION

DETAIL

11-

TRADE NAME USED

FAX NUMBER

DETAILED DESCRIPTION OF BUSINESS

CONTACT PERSON (NAME & TITLE)

TELEPHONE

E-MAIL ADDRESS

Check this box if any changes were made to Part 1.

PART 2: CALCULATION OF TAX

Compute Tax As Instructed (See Reverse For Tax Rates)

●

Applicant who was in business throughout 2005, enter the gross receipts for 2005 per applicant's records in Box A.

●

$

Applicant beginning business after January 1, 2005, but prior to January 1, 2006, enter gross receipts in 2005 here.

Enter estimated gross receipts in 2006 in Box A. An adjustment will be made in the succeeding year.

●

Applicant beginning business on or after January 1, 2006, enter estimated gross receipts from beginning of business to December 31, 2006 in Box A.

An adjustment will be made in the succeeding year.

●

License tax not based on gross receipts, enter annual tax from reverse side in Box B.

Check this box if you are paying in installments.

(See reverse for qualification and instructions.)

If gross receipts in box A are:

(to the nearest dollar)

.

,

,

,

*

0

0

$0 - $10,000: AMOUNT DUE IS $0;

A. GROSS RECEIPTS

Enter $0 in Box B.

TAX RATE (see reverse)

.

,

,

*

$10,001 - $50,000: AMOUNT DUE IS $30;

B. AMOUNT DUE

Enter $30 in Box B.

.

,

,

C. PENALTY (IF LATE)

*

$50,001 - $100,000: AMOUNT DUE IS $50;

.

,

,

Enter $50 in Box B.

D. TOTAL AMOUNT DUE

*

OVER $100,000:

If paying by phone or internet, you must still file this form, either by mail or fax to 703-228-7048.

Multiply gross receipts in box A by tax rate,

** For information and instructions on credit card and e-check payment options, go to:

Enter Result in box B.

Print Name & Title

Telephone

/

/ 2006

Signature

Date

e-mail address

MAIL THIS FORM ALONG WITH YOUR PAYMENT TO THE ADDRESS ON REVERSE USING THE ENCLOSED ENVELOPE

( BE SURE TREASURER'S ADDRESS ON REVERSE SHOWS THROUGH WINDOW OF ENVELOPE)

Keep a copy of this form for your records

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1