Instructions For Ttb F 5000.28t09

ADVERTISEMENT

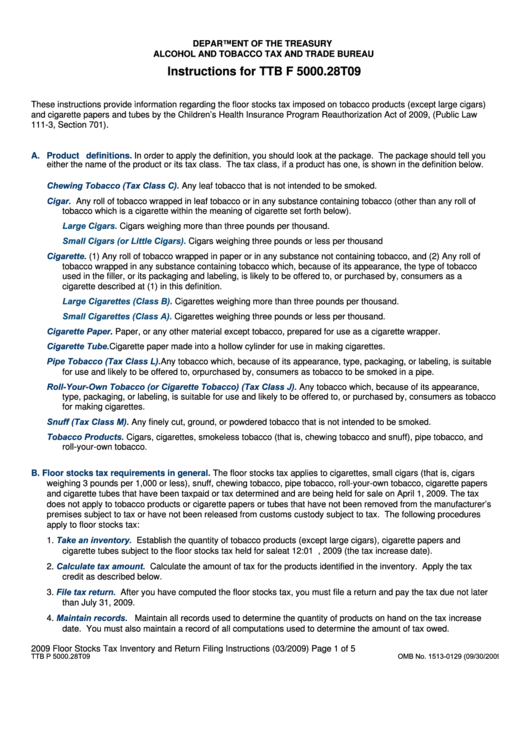

DEPARTMENT OF THE TREASURY

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU

Instructions for TTB F 5000.28T09

These instructions provide information regarding the floor stocks tax imposed on tobacco products (except large cigars)

and cigarette papers and tubes by the Children’s Health Insurance Program Reauthorization Act of 2009, (Public Law

111-3, Section 701).

A. Product definitions.

In order to apply the definition, you should look at the package. The package should tell you

either the name of the product or its tax class. The tax class, if a product has one, is shown in the definition below.

Chewing Tobacco (Tax Class C).

Any leaf tobacco that is not intended to be smoked.

Cigar.

Any roll of tobacco wrapped in leaf tobacco or in any substance containing tobacco (other than any roll of

tobacco which is a cigarette within the meaning of cigarette set forth below).

Large Cigars.

Cigars weighing more than three pounds per thousand.

Small Cigars (or Little Cigars).

Cigars weighing three pounds or less per thousand

Cigarette.

(1) Any roll of tobacco wrapped in paper or in any substance not containing tobacco, and (2) Any roll of

tobacco wrapped in any substance containing tobacco which, because of its appearance, the type of tobacco

used in the filler, or its packaging and labeling, is likely to be offered to, or purchased by, consumers as a

cigarette described at (1) in this definition.

Large Cigarettes (Class B).

Cigarettes weighing more than three pounds per thousand.

Small Cigarettes (Class A).

Cigarettes weighing three pounds or less per thousand.

Cigarette

Paper. Paper, or any other material except tobacco, prepared for use as a cigarette wrapper.

Cigarette Tube.

Cigarette paper made into a hollow cylinder for use in making cigarettes.

Pipe Tobacco (Tax Class L).

Any tobacco which, because of its appearance, type, packaging, or labeling, is suitable

for use and likely to be offered to, or purchased by, consumers as tobacco to be smoked in a pipe.

Roll-Your-Own Tobacco (or Cigarette Tobacco) (Tax Class J).

Any tobacco which, because of its appearance,

type, packaging, or labeling, is suitable for use and likely to be offered to, or purchased by, consumers as tobacco

for making cigarettes.

Snuff (Tax Class M).

Any finely cut, ground, or powdered tobacco that is not intended to be smoked.

Tobacco Products.

Cigars, cigarettes, smokeless tobacco (that is, chewing tobacco and snuff), pipe tobacco, and

roll-your-own tobacco.

B. Floor stocks tax requirements in general.

The floor stocks tax applies to cigarettes, small cigars (that is, cigars

weighing 3 pounds per 1,000 or less), snuff, chewing tobacco, pipe tobacco, roll-your-own tobacco, cigarette papers

and cigarette tubes that have been taxpaid or tax determined and are being held for sale on April 1, 2009. The tax

does not apply to tobacco products or cigarette papers or tubes that have not been removed from the manufacturer’s

premises subject to tax or have not been released from customs custody subject to tax. The following procedures

apply to floor stocks tax:

Take an inventory.

1.

Establish the quantity of tobacco products (except large cigars), cigarette papers and

cigarette tubes subject to the floor stocks tax held for sale at 12:01 a.m. on April 1, 2009 (the tax increase date).

Calculate tax amount.

2.

Calculate the amount of tax for the products identified in the inventory. Apply the tax

credit as described below.

File tax return.

3.

After you have computed the floor stocks tax, you must file a return and pay the tax due not later

than July 31, 2009.

Maintain records.

4.

Maintain all records used to determine the quantity of products on hand on the tax increase

date. You must also maintain a record of all computations used to determine the amount of tax owed.

2009 Floor Stocks Tax Inventory and Return Filing Instructions (03/2009)

Page 1 of 5

TTB P 5000.28T09

OMB No. 1513-0129 (09/30/2009)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5