Form In-1264 - Employer'S Return Of Maine Income Tax Withheld

ADVERTISEMENT

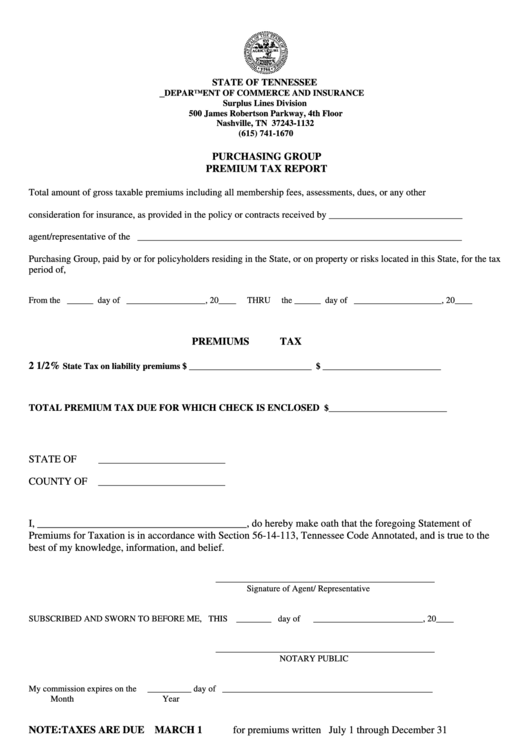

STATE OF TENNESSEE

_DEPARTMENT OF COMMERCE AND INSURANCE

Surplus Lines Division

500 James Robertson Parkway, 4th Floor

Nashville, TN 37243-1132

(615) 741-1670

PURCHASING GROUP

PREMIUM TAX REPORT

Total amount of gross taxable premiums including all membership fees, assessments, dues, or any other

consideration for insurance, as provided in the policy or contracts received by ____________________________

agent/representative of the ____________________________________________________________________

Purchasing Group, paid by or for policyholders residing in the State, or on property or risks located in this State, for the tax

period of,

From the ______ day of __________________, 20____

THRU

the ______ day of ____________________, 20____

PREMIUMS

TAX

2 1/2%

State Tax on liability premiums

$ ____________________________

$ ___________________________

TOTAL PREMIUM TAX DUE FOR WHICH CHECK IS ENCLOSED

$___________________________

STATE OF

_____________________________

COUNTY OF

_____________________________

I, ________________________________________, do hereby make oath that the foregoing Statement of

Premiums for Taxation is in accordance with Section 56-14-113, Tennessee Code Annotated, and is true to the

best of my knowledge, information, and belief.

__________________________________________________

Signature of Agent/ Representative

SUBSCRIBED AND SWORN TO BEFORE ME, THIS ________ day of

_________________________, 20____

__________________________________________________

NOTARY PUBLIC

My commission expires on the

__________ day of ________________________________________________

Month

Year

NOTE:

TAXES ARE DUE MARCH 1

for premiums written July 1 through December 31

TAXES ARE DUE SEPTEMBER 1 for premiums written January 1 through June 30

MUST BE FILED IN DUPLICATE

Form IN-1264 (Revised 2-09)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1