Instructions For 2008 Schedule Rt - State Of Wisconsin

ADVERTISEMENT

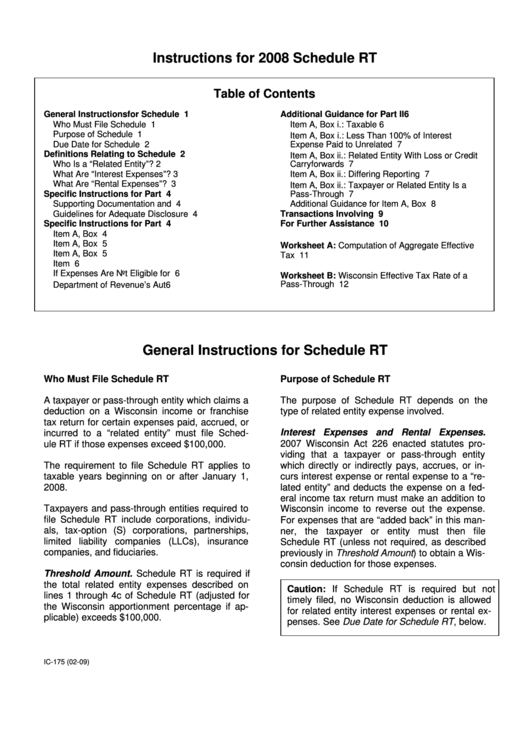

Instructions for 2008 Schedule RT

Table of Contents

General Instructions for Schedule RT ...................1

Additional Guidance for Part II ...............................6

Who Must File Schedule RT ..................................1

Item A, Box i.: Taxable Year ..................................6

Purpose of Schedule RT........................................1

Item A, Box i.: Less Than 100% of Interest

Due Date for Schedule RT.....................................2

Expense Paid to Unrelated Entity ..........................7

Item A, Box ii.: Related Entity With Loss or Credit

Definitions Relating to Schedule RT......................2

Who Is a “Related Entity”? .....................................2

Carryforwards ........................................................7

What Are “Interest Expenses”?..............................3

Item A, Box ii.: Differing Reporting Periods ...........7

What Are “Rental Expenses”? ...............................3

Item A, Box ii.: Taxpayer or Related Entity Is a

Specific Instructions for Part I................................4

Pass-Through Entity ..............................................7

Supporting Documentation and Attachments ........4

Additional Guidance for Item A, Box iii. .................8

Guidelines for Adequate Disclosure ......................4

Transactions Involving REITs ................................9

Specific Instructions for Part II...............................4

For Further Assistance .........................................10

Item A, Box i...........................................................4

Item A, Box ii. .........................................................5

Worksheet A: Computation of Aggregate Effective

Item A, Box iii. ........................................................5

Tax Rates.................................................................11

Item B.....................................................................6

If Expenses Are Not Eligible for Deduction............6

Worksheet B: Wisconsin Effective Tax Rate of a

Department of Revenue’s Authority .......................6

Pass-Through Entity ................................................12

General Instructions for Schedule RT

Who Must File Schedule RT

Purpose of Schedule RT

A taxpayer or pass-through entity which claims a

The purpose of Schedule RT depends on the

deduction on a Wisconsin income or franchise

type of related entity expense involved.

tax return for certain expenses paid, accrued, or

Interest Expenses and Rental Expenses.

incurred to a “related entity” must file Sched-

2007 Wisconsin Act 226 enacted statutes pro-

ule RT if those expenses exceed $100,000.

viding that a taxpayer or pass-through entity

The requirement to file Schedule RT applies to

which directly or indirectly pays, accrues, or in-

taxable years beginning on or after January 1,

curs interest expense or rental expense to a “re-

2008.

lated entity” and deducts the expense on a fed-

eral income tax return must make an addition to

Taxpayers and pass-through entities required to

Wisconsin income to reverse out the expense.

file Schedule RT include corporations, individu-

For expenses that are “added back” in this man-

als, tax-option (S) corporations, partnerships,

ner, the taxpayer or entity must then file

limited liability companies (LLCs), insurance

Schedule RT (unless not required, as described

companies, and fiduciaries.

previously in Threshold Amount) to obtain a Wis-

consin deduction for those expenses.

Threshold Amount. Schedule RT is required if

the total related entity expenses described on

Caution: If Schedule RT is required but not

lines 1 through 4c of Schedule RT (adjusted for

timely filed, no Wisconsin deduction is allowed

the Wisconsin apportionment percentage if ap-

for related entity interest expenses or rental ex-

plicable) exceeds $100,000.

penses. See Due Date for Schedule RT, below.

IC-175 (02-09)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12