Instructions For 2008 Schedule Rt-1

ADVERTISEMENT

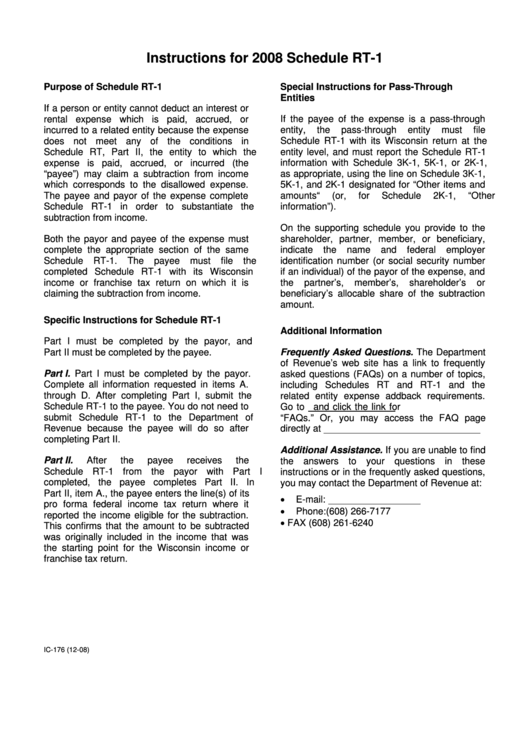

Instructions for 2008 Schedule RT-1

Purpose of Schedule RT-1

Special Instructions for Pass-Through

Entities

If a person or entity cannot deduct an interest or

rental expense which is paid, accrued, or

If the payee of the expense is a pass-through

incurred to a related entity because the expense

entity,

the

pass-through

entity

must

file

does not meet any of the conditions in

Schedule RT-1 with its Wisconsin return at the

Schedule RT, Part II, the entity to which the

entity level, and must report the Schedule RT-1

expense is paid, accrued, or incurred (the

information with Schedule 3K-1, 5K-1, or 2K-1,

“payee”) may claim a subtraction from income

as appropriate, using the line on Schedule 3K-1,

which corresponds to the disallowed expense.

5K-1, and 2K-1 designated for “Other items and

The payee and payor of the expense complete

amounts“

(or,

for

Schedule 2K-1,

“Other

Schedule RT-1 in order to substantiate the

information”).

subtraction from income.

On the supporting schedule you provide to the

Both the payor and payee of the expense must

shareholder, partner, member, or beneficiary,

complete the appropriate section of the same

indicate

the

name

and

federal

employer

Schedule RT-1.

The

payee

must

file

the

identification number (or social security number

completed Schedule RT-1 with its Wisconsin

if an individual) of the payor of the expense, and

income or franchise tax return on which it is

the

partner’s,

member’s,

shareholder’s

or

claiming the subtraction from income.

beneficiary’s allocable share of the subtraction

amount.

Specific Instructions for Schedule RT-1

Additional Information

Part I must be completed by the payor, and

Part II must be completed by the payee.

Frequently Asked Questions. The Department

of Revenue’s web site has a link to frequently

Part I. Part I must be completed by the payor.

asked questions (FAQs) on a number of topics,

Complete all information requested in items A.

including Schedules RT and RT-1 and the

through D. After completing Part I, submit the

related entity expense addback requirements.

Schedule RT-1 to the payee. You do not need to

Go to and click the link for

submit Schedule RT-1 to the Department of

“FAQs.” Or, you may access the FAQ page

Revenue because the payee will do so after

directly at /faqs/index.html.

completing Part II.

Additional Assistance. If you are unable to find

Part II.

After

the

payee

receives

the

the answers to your questions in these

Schedule RT-1 from the payor with Part I

instructions or in the frequently asked questions,

completed, the payee completes Part II. In

you may contact the Department of Revenue at:

Part II, item A., the payee enters the line(s) of its

•

E-mail: corp@revenue.wi.gov

pro forma federal income tax return where it

•

Phone: (608) 266-7177

reported the income eligible for the subtraction.

•

FAX (608) 261-6240

This confirms that the amount to be subtracted

was originally included in the income that was

the starting point for the Wisconsin income or

franchise tax return.

IC-176 (12-08)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1