Employee Request To Withhold Multnomah County Resident Income Tax

ADVERTISEMENT

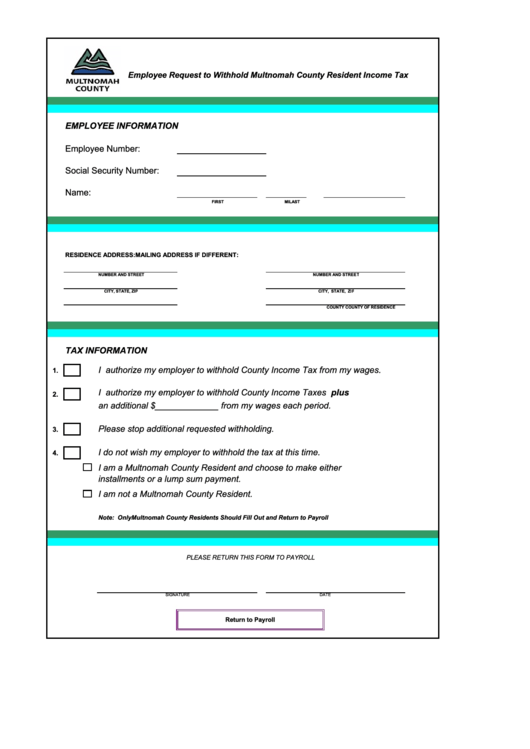

Employee Request to Withhold Multnomah County Resident Income Tax

EMPLOYEE INFORMATION

Employee Number:

Social Security Number:

Name:

FIRST

MI

LAST

RESIDENCE ADDRESS:

MAILING ADDRESS IF DIFFERENT:

NUMBER AND STREET

NUMBER AND STREET

CITY, STATE, ZIP

CITY, STATE, ZIP

COUNTY OF RESIDENCE

COUNTY

TAX INFORMATION

I authorize my employer to withhold County Income Tax from my wages.

1.

I authorize my employer to withhold County Income Taxes plus

2.

an additional $_____________ from my wages each period.

Please stop additional requested withholding.

3.

I do not wish my employer to withhold the tax at this time.

4.

I am a Multnomah County Resident and choose to make either

installments or a lump sum payment.

I am not a Multnomah County Resident.

Note: Only Multnomah County Residents Should Fill Out and Return to Payroll

PLEASE RETURN THIS FORM TO PAYROLL

SIGNATURE

DATE

Return to Payroll

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1