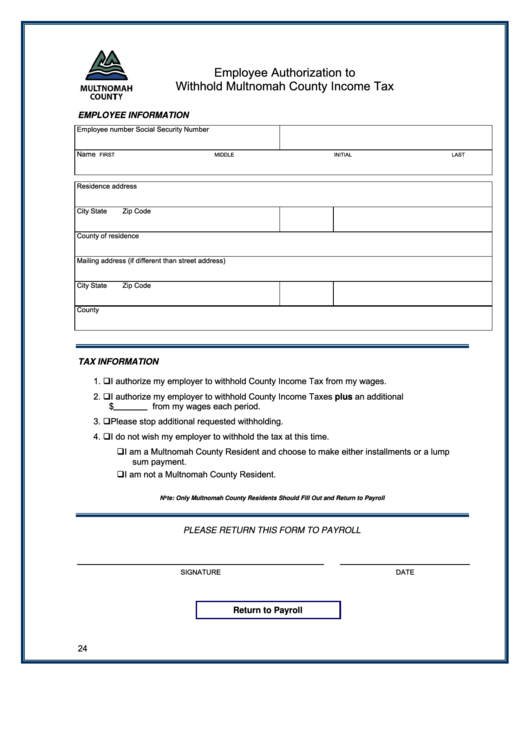

Employee Authorization To Withhold Multnomah County Income Tax Form - Multnomah County - Oregon

ADVERTISEMENT

Employee Authorization to

Withhold Multnomah County Income Tax

EMPLOYEE INFORMATION

Employee number

Social Security Number

Name

FIRST

MIDDLE INITIAL

LAST

Residence address

City

State

Zip Code

County of residence

Mailing address (if different than street address)

City

State

Zip Code

County

TAX INFORMATION

1.

I authorize my employer to withhold County Income Tax from my wages.

2.

I authorize my employer to withhold County Income Taxes plus an additional

$

from my wages each period.

3.

Please stop additional requested withholding.

4.

I do not wish my employer to withhold the tax at this time.

I am a Multnomah County Resident and choose to make either installments or a lump

sum payment.

I am not a Multnomah County Resident.

Note: Only Multnomah County Residents Should Fill Out and Return to Payroll

PLEASE RETURN THIS FORM TO PAYROLL

SIGNATURE

DATE

Return to Payroll

24

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1