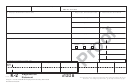

Form W-2 - Wage And Tax Statement - 2008 Page 2

ADVERTISEMENT

a Employee’s social security number

OMB No. 1545-0008

1 Wages, tips, other compensation

2 Federal income tax withheld

b Employer identification number (EIN)

3 Social security wages

4 Social security tax withheld

c Employer’s name, address, and ZIP code

5 Medicare wages and tips

6 Medicare tax withheld

7 Social security tips

8 Allocated tips

9 Advance EIC payment

10 Dependent care benefits

d Control number

e Employee’s first name and initial

Last name

11 Nonqualified plans

12a See instructions for box 12

Suff.

c

o

d

e

Statutory

Retirement

Third-party

13

12b

employee

plan

sick pay

c

o

d

e

14 Other

12c

c

o

d

e

12d

c

o

d

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5

e

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5

f Employee’s address and ZIP code

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5

15

Employer’s KY withholding tax ID number

16 KY wages, tips, etc.

17 KY income tax

18 Local wages, tips, etc. 19 Local income tax

20 Locality name

KY

&

Wage and Tax

Department of the Treasury–Internal Revenue Service

K-2

Statement

K-2 Forms can be submitted online

Form

at

Copy 1— For Kentucky Department of Revenue

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6