Form Ct-945 Athen - Connecticut Annual Reconciliation Of Withholding For Nonpayroll Amounts - 2008

ADVERTISEMENT

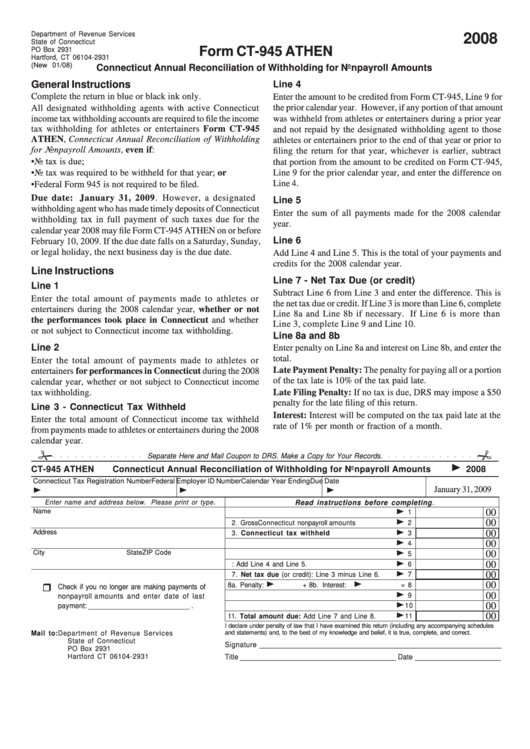

Department of Revenue Services

2008

State of Connecticut

Form CT-945 ATHEN

PO Box 2931

Hartford, CT 06104-2931

(New 01/08)

Connecticut Annual Reconciliation of Withholding for Nonpayroll Amounts

General Instructions

Line 4

Complete the return in blue or black ink only.

Enter the amount to be credited from Form CT-945, Line 9 for

the prior calendar year. However, if any portion of that amount

All designated withholding agents with active Connecticut

income tax withholding accounts are required to file the income

was withheld from athletes or entertainers during a prior year

tax withholding for athletes or entertainers Form CT-945

and not repaid by the designated withholding agent to those

ATHEN, Connecticut Annual Reconciliation of Withholding

athletes or entertainers prior to the end of that year or prior to

for Nonpayroll Amounts, even if:

filing the return for that year, whichever is earlier, subtract

• No tax is due;

that portion from the amount to be credited on Form CT-945,

• No tax was required to be withheld for that year; or

Line 9 for the prior calendar year, and enter the difference on

Line 4.

• Federal Form 945 is not required to be filed.

Due date: January 31, 2009. However, a designated

Line 5

withholding agent who has made timely deposits of Connecticut

Enter the sum of all payments made for the 2008 calendar

withholding tax in full payment of such taxes due for the

year.

calendar year 2008 may file Form CT-945 ATHEN on or before

Line 6

February 10, 2009. If the due date falls on a Saturday, Sunday,

or legal holiday, the next business day is the due date.

Add Line 4 and Line 5. This is the total of your payments and

credits for the 2008 calendar year.

Line Instructions

Line 7 - Net Tax Due (or credit)

Line 1

Subtract Line 6 from Line 3 and enter the difference. This is

Enter the total amount of payments made to athletes or

the net tax due or credit. If Line 3 is more than Line 6, complete

entertainers during the 2008 calendar year, whether or not

Line 8a and Line 8b if necessary. If Line 6 is more than

the performances took place in Connecticut and whether

Line 3, complete Line 9 and Line 10.

or not subject to Connecticut income tax withholding.

Line 8a and 8b

Line 2

Enter penalty on Line 8a and interest on Line 8b, and enter the

total.

Enter the total amount of payments made to athletes or

Late Payment Penalty: The penalty for paying all or a portion

entertainers for performances in Connecticut during the 2008

of the tax late is 10% of the tax paid late.

calendar year, whether or not subject to Connecticut income

tax withholding.

Late Filing Penalty: If no tax is due, DRS may impose a $50

penalty for the late filing of this return.

Line 3 - Connecticut Tax Withheld

Interest: Interest will be computed on the tax paid late at the

Enter the total amount of Connecticut income tax withheld

rate of 1% per month or fraction of a month.

from payments made to athletes or entertainers during the 2008

calendar year.

Separate Here and Mail Coupon to DRS. Make a Copy for Your Records.

CT-945 ATHEN

Connecticut Annual Reconciliation of Withholding for Nonpayroll Amounts

2008

Connecticut Tax Registration Number

Federal Employer ID Number

Calendar Year Ending

Due Date

January 31, 2009

Enter name and address below. Please print or type.

Read instructions before completing.

Name

00

1. Gross nonpayroll amounts

1

00

2. Gross Connecticut nonpayroll amounts

2

Address

00

3. Connecticut tax withheld

3

00

4. Credit from prior year

4

City

State

ZIP Code

00

5. Payments made for this year

5

00

6. Total payments: Add Line 4 and Line 5.

6

00

7. Net tax due (or credit): Line 3 minus Line 6.

7

00

8a. Penalty:

+ 8b. Interest:

= 8

Check if you no longer are making payments of

00

9. Amount to be credited

9

nonpayroll amounts and enter date of last

00

payment: __________________________ .

10. Amount to be refunded

10

00

11. Total amount due: Add Line 7 and Line 8.

11

I declare under penalty of law that I have examined this return (including any accompanying schedules

Mail to:

Department of Revenue Services

and statements) and, to the best of my knowledge and belief, it is true, complete, and correct.

State of Connecticut

Signature ______________________________________________________________

PO Box 2931

Hartford CT 06104-2931

Title ________________________________________ Date ______________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2