Return Of Business Tangible Personal Property Form - Richmond Division Of Assessments - 2012

ADVERTISEMENT

2012

CITY OF RICHMOND

Return of Business Tangible Personal Property

P l e a s e d o n o t w r i t e i n S H A D E D a r e a s .

PLEASE PRINT ALL

CUSTOMER #

PROPERTY#

RETURN#

PROCESSORS INITIALS

INFORMATION

TYPE OF BUSINESS____________________________

TAXPAYER NAME/ADDRESS:

BUSINESS PHONE_____________________________

FEDERAL I.D.__________________________________

FAX NUMBER__________________________________

E-MAIL________________________________________

DATE BUSINESS BEGAN ________/_______/________

DATE BUSINESS CLOSE _______/_______/_________

LOCATION / ADDRESS OF PROPERTY ________________________________________________________________________

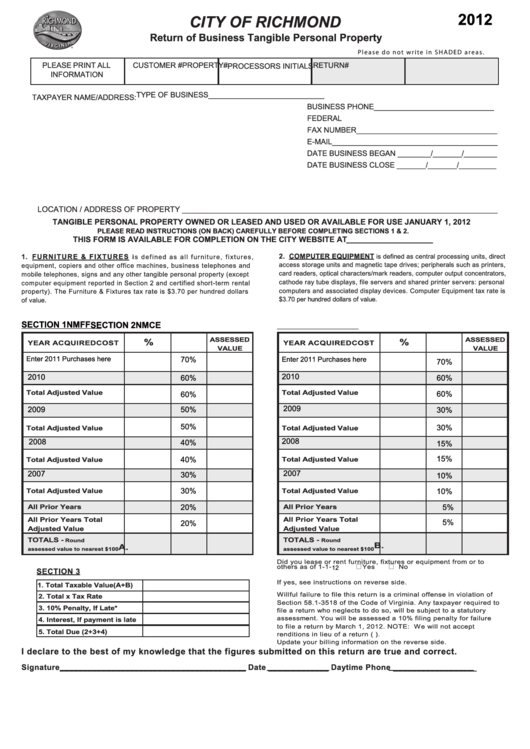

TANGIBLE PERSONAL PROPERTY OWNED OR LEASED AND USED OR AVAILABLE FOR USE JANUARY 1, 2012

PLEASE READ INSTRUCTIONS (ON BACK) CAREFULLY BEFORE COMPLETING SECTIONS 1 & 2.

THIS FORM IS AVAILABLE FOR COMPLETION ON THE CITY WEBSITE AT

2. COMPUTER EQUIPMENT

is defined as central processing units, direct

1. F U RN IT URE & FI XT UR ES

i s d e f i n e d a s a l l f u r n i t u r e , f i x t u r e s ,

access storage units and magnetic tape drives; peripherals such as printers,

equipment, copiers and other office machines, business telephones and

card readers, optical characters/mark readers, computer output concentrators,

mobile telephones, signs and any other tangible personal property (except

cathode ray tube displays, file servers and shared printer servers: personal

computer equipment reported in Section 2 and certified short-term rental

computers and associated display devices. Computer Equipment tax rate is

property). The Furniture & Fixtures tax rate is $3.70 per hundred dollars

$3.70 per hundred dollars of value.

of value.

SECTION 1

NMFF

SECTION 2

NMCE

ASSESSED

%

ASSESSED

%

YEAR ACQUIRED

COST

YEAR ACQUIRED

COST

VALUE

VALUE

Enter 2011 Purchases here

70%

Enter 2011 Purchases here

70%

2010

2010

60%

60%

Total Adjusted Value

Total Adjusted Value

60%

60%

2009

2009

50%

30%

50%

30%

Total Adjusted Value

Total Adjusted Value

2008

2008

40%

15%

15%

Total Adjusted Value

40%

Total Adjusted Value

2007

2007

30%

10%

30%

10%

Total Adjusted Value

Total Adjusted Value

20%

All Prior Years

All Prior Years

5%

All Prior Years Total

All Prior Years Total

5%

20%

Adjusted Value

Adjusted Value

TOTALS -

TOTALS -

Round

Round

B.

A.

assessed value to nearest $100

assessed value to nearest $100

Did you lease or rent furniture, fixtures or equipment from or to

�

�

others as of 1-1-

12

Yes

No

SECTION 3

If yes, see instructions on reverse side.

1. Total Taxable Value(A+B)

Willful failure to file this return is a criminal offense in violation of

2. Total x Tax Rate

Section 58.1-3518 of the Code of Virginia. Any taxpayer required to

3. 10% Penalty, If Late*

file a return who neglects to do so, will be subject to a statutory

assessment. You will be assessed a 10% filing penalty for failure

4. Interest, If payment is late

to file a return by March 1, 2012. NOTE: We will not accept

5. Total Due (2+3+4)

renditions in lieu of a return (i.e. 762).

Update your billing information on the reverse side.

I declare to the best of my knowledge that the figures submitted on this return are true and correct.

Signature________________________________________ Date _____________ Daytime Phone __________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2