Return Of Business Tangible Personal Property Form - City Of Harrisonburg, Virginia

ADVERTISEMENT

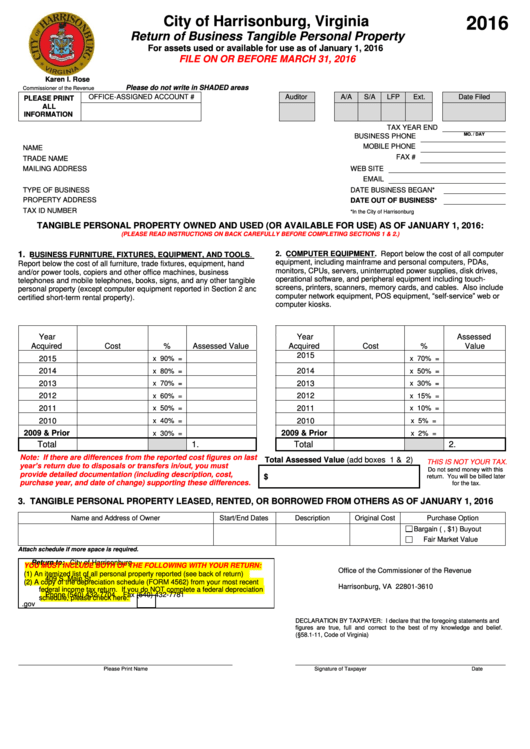

City of Harrisonburg, Virginia

2016

Return of Business Tangible Personal Property

For assets used or available for use as of January 1, 2016

FILE ON OR BEFORE MARCH 31, 2016

Karen I. Rose

Please do not write in SHADED areas

Commissioner of the Revenue

OFFICE-ASSIGNED ACCOUNT #

Auditor

A/A

S/A

LFP

Ext.

Date Filed

PLEASE PRINT

ALL

INFORMATION

TAX YEAR END

MO. / DAY

BUSINESS PHONE

NAME

MOBILE PHONE

TRADE NAME

FAX #

MAILING ADDRESS

WEB SITE

EMAIL

TYPE OF BUSINESS

DATE BUSINESS BEGAN*

PROPERTY ADDRESS

DATE OUT OF BUSINESS*

TAX ID NUMBER

*In the City of Harrisonburg

TANGIBLE PERSONAL PROPERTY OWNED AND USED (OR AVAILABLE FOR USE) AS OF JANUARY 1, 2016:

(PLEASE READ INSTRUCTIONS ON BACK CAREFULLY BEFORE COMPLETING SECTIONS 1 & 2.)

1.

2. COMPUTER EQUIPMENT. Report below the cost of all computer

BUSINESS FURNITURE, FIXTURES, EQUIPMENT, AND TOOLS.

equipment, including mainframe and personal computers, PDAs,

Report below the cost of all furniture, trade fixtures, equipment, hand

monitors, CPUs, servers, uninterrupted power supplies, disk drives,

and/or power tools, copiers and other office machines, business

operational software, and peripheral equipment including touch-

telephones and mobile telephones, books, signs, and any other tangible

screens, printers, scanners, memory cards, and cables. Also include

personal property (except computer equipment reported in Section 2 and

computer network equipment, POS equipment, “self-service” web or

certified short-term rental property).

computer kiosks.

Year

Year

Assessed

Acquired

Cost

%

Assessed Value

Acquired

Cost

%

Value

2015

2015

x 90% =

x 70% =

2014

2014

x 80% =

x 50% =

2013

2013

x 70% =

x 30% =

2012

2012

x 60% =

x 15% =

2011

2011

x 50% =

x 10% =

2010

2010

x 40% =

x 5% =

2009 & Prior

2009 & Prior

x 30% =

x 2% =

Total

1.

Total

2.

Note: If there are differences from the reported cost figures on last

Total Assessed Value (add boxes 1 & 2)

THIS IS NOT YOUR TAX.

year’s return due to disposals or transfers in/out, you must

Do not send money with this

provide detailed documentation (including description, cost,

$

return. You will be billed later

purchase year, and date of change) supporting these differences.

for the tax.

3. TANGIBLE PERSONAL PROPERTY LEASED, RENTED, OR BORROWED FROM OTHERS AS OF JANUARY 1, 2016

Name and Address of Owner

Start/End Dates

Description

Original Cost

Purchase Option

Bargain (e.g., $1) Buyout

Fair Market Value

Attach schedule if more space is required.

Return to: City of Harrisonburg

YOU MUST INCLUDE BOTH OF THE FOLLOWING WITH YOUR RETURN:

Office of the Commissioner of the Revenue

(1) An itemized list of all personal property reported (see back of return)

409 S. Main St.

(2) A copy of the depreciation schedule (FORM 4562) from your most recent

Harrisonburg, VA 22801-3610

federal income tax return. If you do NOT complete a federal depreciation

Phone (540) 432-7704

Fax (540) 432-7781

schedule, please check here:

ctycomm@ci.harrisonburg.va.us

ctycomm@harrisonburgva.gov

DECLARATION BY TAXPAYER: I declare that the foregoing statements and

figures are true, full and correct to the best of my knowledge and belief.

(§58.1-11, Code of Virginia)

Please Print Name

Signature of Taxpayer

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2