Instructions For Form Ct-5.4 - Request For Six-Month Extension To File New York S Corporation Franchise Tax Return - 2005

ADVERTISEMENT

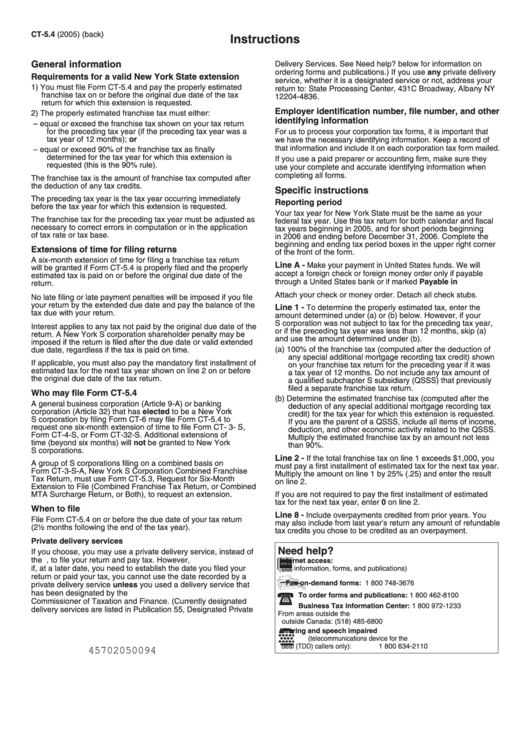

CT-5.4 (2005) (back)

Instructions

General information

Delivery Services. See Need help? below for information on

ordering forms and publications.) If you use any private delivery

Requirements for a valid New York State extension

service, whether it is a designated service or not, address your

1) You must file Form CT-5.4 and pay the properly estimated

return to: State Processing Center, 431C Broadway, Albany NY

franchise tax on or before the original due date of the tax

12204-4836.

return for which this extension is requested.

Employer identification number, file number, and other

2) The properly estimated franchise tax must either:

identifying information

– equal or exceed the franchise tax shown on your tax return

for the preceding tax year (if the preceding tax year was a

For us to process your corporation tax forms, it is important that

tax year of 12 months); or

we have the necessary identifying information. Keep a record of

that information and include it on each corporation tax form mailed.

– equal or exceed 90% of the franchise tax as finally

determined for the tax year for which this extension is

If you use a paid preparer or accounting firm, make sure they

requested (this is the 90% rule).

use your complete and accurate identifying information when

completing all forms.

The franchise tax is the amount of franchise tax computed after

the deduction of any tax credits.

Specific instructions

The preceding tax year is the tax year occurring immediately

Reporting period

before the tax year for which this extension is requested.

Your tax year for New York State must be the same as your

The franchise tax for the preceding tax year must be adjusted as

federal tax year. Use this tax return for both calendar and fiscal

necessary to correct errors in computation or in the application

tax years beginning in 2005, and for short periods beginning

of tax rate or tax base.

in 2006 and ending before December 31, 2006. Complete the

beginning and ending tax period boxes in the upper right corner

Extensions of time for filing returns

of the front of the form.

A six-month extension of time for filing a franchise tax return

Line A -

Make your payment in United States funds. We will

will be granted if Form CT-5.4 is properly filed and the properly

accept a foreign check or foreign money order only if payable

estimated tax is paid on or before the original due date of the

through a United States bank or if marked Payable in U.S. funds.

return.

Attach your check or money order. Detach all check stubs.

No late filing or late payment penalties will be imposed if you file

your return by the extended due date and pay the balance of the

Line 1 -

To determine the properly estimated tax, enter the

tax due with your return.

amount determined under (a) or (b) below. However, if your

S corporation was not subject to tax for the preceding tax year,

Interest applies to any tax not paid by the original due date of the

or if the preceding tax year was less than 12 months, skip (a)

return. A New York S corporation shareholder penalty may be

and use the amount determined under (b).

imposed if the return is filed after the due date or valid extended

(a) 100% of the franchise tax (computed after the deduction of

due date, regardless if the tax is paid on time.

any special additional mortgage recording tax credit) shown

If applicable, you must also pay the mandatory first installment of

on your franchise tax return for the preceding year if it was

estimated tax for the next tax year shown on line 2 on or before

a tax year of 12 months. Do not include any tax amount of

the original due date of the tax return.

a qualified subchapter S subsidiary (QSSS) that previously

filed a separate franchise tax return.

Who may file Form CT-5.4

(b) Determine the estimated franchise tax (computed after the

A general business corporation (Article 9-A) or banking

deduction of any special additional mortgage recording tax

corporation (Article 32) that has elected to be a New York

credit) for the tax year for which this extension is requested.

S corporation by filing Form CT-6 may file Form CT-5.4 to

If you are the parent of a QSSS, include all items of income,

request one six-month extension of time to file Form CT- 3- S,

deduction, and other economic activity related to the QSSS.

Form CT-4-S, or Form CT-32-S. Additional extensions of

Multiply the estimated franchise tax by an amount not less

time (beyond six months) will not be granted to New York

than 90%.

S corporations.

Line 2 -

If the total franchise tax on line 1 exceeds $1,000, you

A group of S corporations filing on a combined basis on

must pay a first installment of estimated tax for the next tax year.

Form CT-3-S-A, New York S Corporation Combined Franchise

Multiply the amount on line 1 by 25% (.25) and enter the result

Tax Return, must use Form CT-5.3, Request for Six-Month

on line 2.

Extension to File (Combined Franchise Tax Return, or Combined

MTA Surcharge Return, or Both), to request an extension.

If you are not required to pay the first installment of estimated

tax for the next tax year, enter 0 on line 2.

When to file

Line 8 -

Include overpayments credited from prior years. You

File Form CT-5.4 on or before the due date of your tax return

may also include from last year’s return any amount of refundable

(2½ months following the end of the tax year).

tax credits you chose to be credited as an overpayment.

Private delivery services

Need help?

If you choose, you may use a private delivery service, instead of

the U.S. Postal Service, to file your return and pay tax. However,

Internet access:

if, at a later date, you need to establish the date you filed your

(for information, forms, and publications)

return or paid your tax, you cannot use the date recorded by a

Fax-on-demand forms:

1 800 748-3676

private delivery service unless you used a delivery service that

has been designated by the U.S. Secretary of the Treasury or the

To order forms and publications:

1 800 462-8100

Commissioner of Taxation and Finance. (Currently designated

Business Tax Information Center:

1 800 972-1233

delivery services are listed in Publication 55, Designated Private

From areas outside the U.S. and

outside Canada:

(518) 485-6800

Hearing and speech impaired

(telecommunications device for the

deaf (TDD) callers only):

1 800 634-2110

45702050094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1