Form Deed-13 - Report To Determine Liability For Unemployment Tax

ADVERTISEMENT

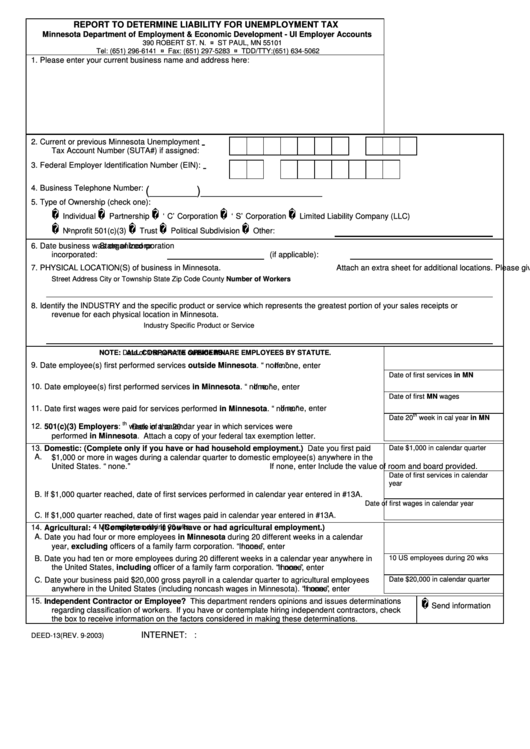

REPORT TO DETERMINE LIABILITY FOR UNEMPLOYMENT TAX

Minnesota Department of Employment & Economic Development - UI Employer Accounts

390 ROBERT ST. N. ¤ ST PAUL, MN 55101

Tel: (651) 296-6141 ¤ Fax: (651) 297-5283 ¤ TDD/TTY:(651) 634-5062

1.

Please enter your current business name and address here:

2.

Current or previous Minnesota Unemployment

-

Tax Account Number (SUTA#) if assigned:

3.

Federal Employer Identification Number (EIN):

-

4.

Business Telephone Number:

(_______)__________________

5.

Type of Ownership (check one):

�

�

�

�

�

Individual

Partnership

‘ C’Corporation

‘ S’Corporation

Limited Liability Company (LLC)

�

�

�

�

Nonprofit 501(c)(3)

Trust

Political Subdivision

Other:

6.

Date business was organized or

State of Incorporation

incorporated:

(if applicable):

7.

PHYSICAL LOCATION(S) of business in Minnesota.

Please give street address.

Attach an extra sheet for additional locations.

Street Address

City or Township

State

Zip Code

County

Number of Workers

8.

Identify the INDUSTRY and the specific product or service which represents the greatest portion of your sales receipts or

revenue for each physical location in Minnesota.

Industry

Specific Product or Service

NOTE:

ALL CORPORATE OFFICERS ARE EMPLOYEES BY STATUTE.

Date of first services outside MN

9.

Date employee(s) first performed services outside Minnesota.

If none, enter

“ none.”

Date of first services in MN

10.

Date employee(s) first performed services in Minnesota.

If none, enter

“ none.”

Date of first MN wages

11.

Date first wages were paid for services performed in Minnesota.

If none, enter

“ none.”

th

Date 20

week in cal year in MN

th

12.

501(c)(3) Employers:

Date of the 20

week in a calendar year in which services were

performed in Minnesota.

Attach a copy of your federal tax exemption letter.

13.

Date $1,000 in calendar quarter

Domestic: (Complete only if you have or had household employment.) Date you first paid

A.

$1,000 or more in wages during a calendar quarter to domestic employee(s) anywhere in the

United States.

Include the value of room and board provided.

If none, enter

“ none.”

Date of first services in calendar

year

B.

If $1,000 quarter reached, date of first services performed in calendar year entered in #13A.

Date of first wages in calendar year

C.

If $1,000 quarter reached, date of first wages paid in calendar year entered in #13A.

14.

Agricultural:

(Complete only if you have or had agricultural employment.)

4 MN employees during 20 wks

A.

Date you had four or more employees in Minnesota during 20 different weeks in a calendar

year, excluding officers of a family farm corporation.

If none, enter

“ none.”

10 US employees during 20 wks

B.

Date you had ten or more employees during 20 different weeks in a calendar year anywhere in

the United States, including officer of a family farm corporation.

If none, enter

“ none.”

C.

Date your business paid $20,000 gross payroll in a calendar quarter to agricultural employees

Date $20,000 in calendar quarter

anywhere in the United States (including noncash wages in Minnesota).

If none, enter

“ none.”

�

15.

Independent Contractor or Employee? This department renders opinions and issues determinations

Send information

regarding classification of workers.

If you have or contemplate hiring independent contractors, check

the box to receive information on the factors considered in making these determinations.

INTERNET:

-

E-MAIL: deed.tax.liability@state.mn.us

DEED-13 (REV. 9-2003)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2