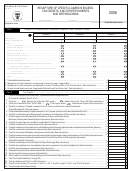

Schedule B Individual - Recapture Of Credit Claimed In Excess, Tax Credits, And Other Payments And Withholdings - 2008 Page 2

ADVERTISEMENT

Rev. 12.08

Schedule B Individual - Page 2

Part III

Other Payments and Withholdings

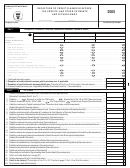

00

1.

Estimated tax payments for 2008 ..............................................................................................................................................

(41)

00

2.

Tax paid in excess in prior years credited to estimated tax .......................................................................................................

(42)

00

3.

Tax withheld to nonresidents (Form 480.6C) ..........................................................................................................................

(43)

00

4.

Tax withheld on interest (Schedule F Individual, Part I, line 8) .................................................................................................

(44)

00

5.

Dividends from corporations or distributions from partnerships (Schedule F Individual, Part II, line 5A) ....................................

(45)

6.

Dividends from corporations or distributions from partnerships operating under Act No. 8 of 1987

00

(Form 480.6B):

10%

5%

2% ................................................................................................................

(46)

00

7.

Dividends from Capital Investment or Tourism Funds (Submit Schedule Q1) ............................................................................

(47)

00

8.

Services rendered by individuals (Form 480.6B) ....................................................................................................................

(48)

00

9.

Payments for judicial or extrajudicial indemnification (Form 480.6B)..........................................................................................

(49)

10.

Tax withheld on distributable share of net profits to stockholders of corporations of individuals

00

(Form 480.6 CI) ......................................................................................................................................................................

(50)

00

11.

Tax withheld on distributable share of net profits to partners of special partnerships (Form 480.6 SE) ......................................

(51)

12.

Tax withheld on IRA or Educational Contribution Accounts distributions of income from sources within Puerto Rico

00

(Form 480.7 and/or 480.7B) ...................................................................................................................................................

(52)

00

13.

Tax withheld on IRA distributions to Government pensioners (Form 480.7) .............................................................................

(53)

00

14.

Tax withheld at source on qualified pension plans distributions (Form 480.7C) ........................................................................

(54)

00

15.

Tax withheld on distributions and transfers from Governmental Plans (Form 480.7C) ...............................................................

(55)

00

16.

Other payments and withholdings not included on the preceding lines (Submit detail) ...............................................................

(56)

00

17.

Total other payments and withholdings (Add lines 1 through 16. Transfer to page 2, Part 4, line 31C of the return) ........

(57)

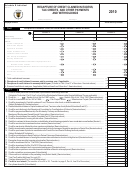

Part IV

Breakdown of the Purchase of Tax Credits

Fill in the oval corresponding to the act (or acts) under which you acquired the credit and enter the amount:

00

Tourism Development .............................................................................................................................................

(58)

00

Solid Waste Disposal .............................................................................................................................................

(59)

00

Agricultural Incentives .............................................................................................................................................

(60)

00

Capital Investment Fund ..........................................................................................................................................

(61)

00

Theatrical District of Santurce ..................................................................................................................................

(62)

00

Film Industry Development ......................................................................................................................................

(63)

00

Housing Infrastructure .............................................................................................................................................

(64)

00

Construction or Rehabilitation of Rental Housing Projects for Low or Moderate Income Families .................................

(65)

00

Conservation Easement ..........................................................................................................................................

(66)

00

Revitalization of Urban Centers ...............................................................................................................................

(67)

00

Acquisition of an Exempt Business that is in the Process of Closing its Operations in Puerto Rico ................................

(68)

00

Economic Incentives (Research and Development) ..................................................................................................

(69)

00

Economic Incentives (Strategic Projects) ..................................................................................................................

(70)

00

Economic Incentives (Industrial Investment) .............................................................................................................

(71)

00

Other: _________________________________ .....................................................................................................

(72)

00

Total credit for the purchase of tax credits (Same as Part II, line 8) .................................................................................................

(73)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2