Schedule Co Individual - Optional Computation Of Tax Form -2008

ADVERTISEMENT

E

O

0

8

0

0

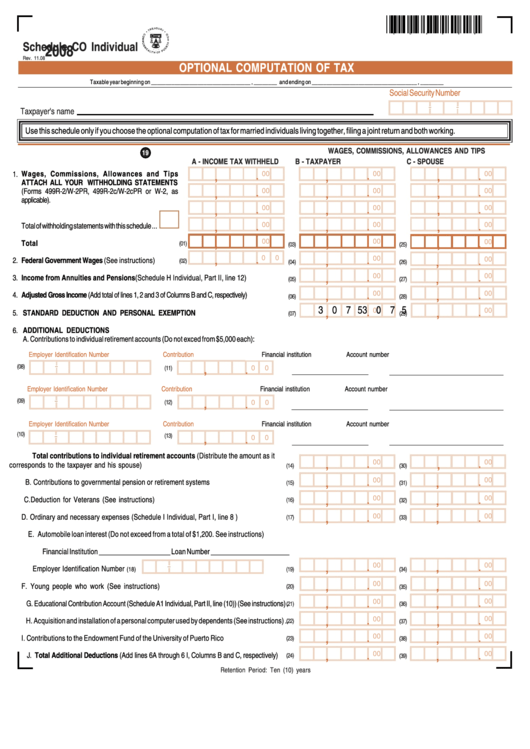

Schedule CO Individual

2008

Rev. 11.08

OPTIONAL COMPUTATION OF TAX

Taxable year beginning on __________________________________ , ________ and ending on ____________________________________ , ________

Social Security Number

Taxpayer's name

Use this schedule only if you choose the optional computation of tax for married individuals living together, filing a joint return and both working.

WAGES, COMMISSIONS, ALLOWANCES AND TIPS

19

A - INCOME TAX WITHHELD

B - TAXPAYER

C - SPOUSE

1.

Wages, Commissions, Allowances and Tips

.

0

0

.

0

0

.

0

0

,

,

,

ATTACH ALL YOUR WITHHOLDING STATEMENTS

(Forms 499R-2/W-2PR, 499R-2c/W-2cPR or W-2, as

.

0

0

.

0

0

.

0

0

,

,

,

applicable).

.

0

0

.

0

0

.

0

0

,

,

,

Total of withholding statements with this schedule ...

.

0

0

.

0

0

.

0

0

,

,

,

Total ....................................................................

.

0

0

0

0

.

0

0

(01)

.

.

,

,

.

(03)

(25)

,

.

0

0

.

2.

Federal Government Wages (See instructions) ............

0

0

.

0

0

,

(02)

(04)

,

(26)

,

.

3.

Income from Annuities and Pensions (Schedule H Individual, Part II, line 12) ...................

0

0

.

0

0

(05)

,

(27)

,

Adjusted Gross Income (Add total of lines 1, 2 and 3 of Columns B and C, respectively) ........................

4.

.

0

0

.

0

0

(06)

,

(28)

,

3 0 7 5

3 0 7 5

.

.

STANDARD DEDUCTION AND PERSONAL EXEMPTION ...................................................

0

0

0

0

5.

(07)

(29)

,

,

6.

ADDITIONAL DEDUCTIONS

A. Contributions to individual retirement accounts (Do not exced from $5,000 each):

Employer Identification Number

Contribution

Financial institution

Account number

(08)

(11)

.

0

0

,

Employer Identification Number

Contribution

Financial institution

Account number

(09)

(12)

.

0

0

,

Employer Identification Number

Contribution

Financial institution

Account number

(10)

(13)

.

0

0

,

Total contributions to individual retirement accounts (Distribute the amount as it

.

0

0

.

0

0

corresponds to the taxpayer and his spouse) ...............................................................

,

,

(14)

(30)

.

B. Contributions to governmental pension or retirement systems .......................................

.

0

0

0

0

(15)

,

(31)

,

C. Deduction for Veterans (See instructions) ....................................................................

.

0

0

.

0

0

(16)

(32)

,

,

D. Ordinary and necessary expenses (Schedule I Individual, Part I, line 8 ) ......................

.

.

0

0

0

0

(17)

(33)

,

,

E. Automobile loan interest (Do not exceed from a total of $1,200. See instructions)

Financial Institution ____________________ Loan Number ______________________

.

0

0

.

0

0

Employer Identification Number

.....

,

,

(18)

(19)

(34)

.

0

0

.

0

0

F. Young people who work (See instructions) .................................................................

(20)

(35)

,

,

.

.

0

0

G. Educational Contribution Account (Schedule A1 Individual, Part II, line (10)) (See instructions) .

0

0

(21)

(36)

,

,

H. Acquisition and installation of a personal computer used by dependents (See instructions) ..

.

.

0

0

0

0

(22)

(37)

,

,

I. Contributions to the Endowment Fund of the University of Puerto Rico ................................

.

0

0

.

0

0

(23)

(38)

,

,

J. Total Additional Deductions (Add lines 6A through 6 I, Columns B and C, respectively) .....

.

0

0

.

0

0

(24)

(39)

,

,

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2