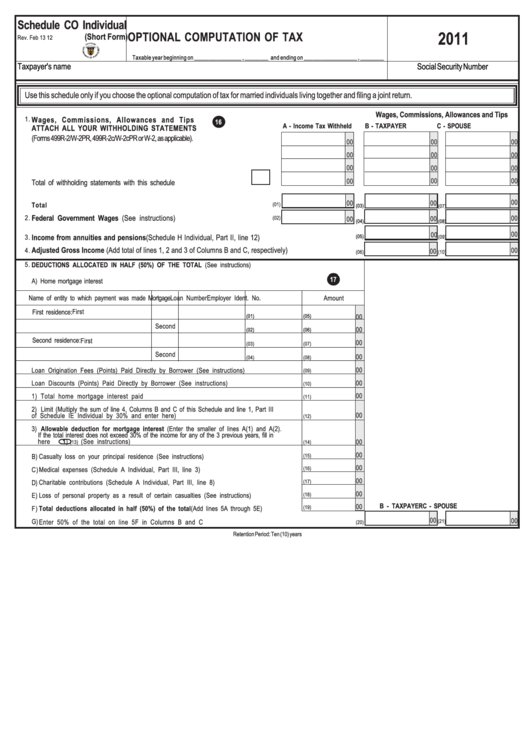

Schedule Co Individual - Optional Computation Of Tax (Short Form) - 2011

ADVERTISEMENT

Schedule CO Individual

2011

OPTIONAL COMPUTATION OF TAX

(Short Form)

Rev. Feb 13 12

Taxable year beginning on ________________ , ________ and ending on __________________ , ________

Taxpayer's name

Social Security Number

Use this schedule only if you choose the optional computation of tax for married individuals living together and filing a joint return.

Wages, Commissions, Allowances and Tips

Wages, Commissions, Allowances and Tips

1.

16

A - Income Tax Withheld

B - TAXPAYER

C - SPOUSE

ATTACH ALL YOUR WITHHOLDING STATEMENTS

(Forms 499R-2/W-2PR, 499R-2c/W-2cPR or W-2, as applicable).

00

00

00

00

00

00

00

00

00

00

00

00

Total of withholding statements with this schedule

.............................................

00

00

00

Total ..................................................................................................................

(01)

(03)

(07)

Federal Government Wages (See instructions) ............

2.

...........................................

00

(02)

00

00

(04)

(08)

00

00

Income from annuities and pensions (Schedule H Individual, Part II, line 12) ..............................................

3.

(05)

(09)

Adjusted Gross Income (Add total of lines 1, 2 and 3 of Columns B and C, respectively) ..................................

4.

00

00

(06)

(10)

5.

DEDUCTIONS ALLOCATED IN HALF (50%) OF THE TOTAL (See instructions)

17

A) Home mortgage interest

Name of entity to which payment was made

Mortgage

Loan Number

Employer Ident. No.

Amount

First

First residence:

(01)

(05)

00

Second

00

(02)

(06)

Second residence:

First

00

(03)

(07)

Second

00

(04)

(08)

00

Loan Origination Fees (Points) Paid Directly by Borrower (See instructions) ..............................

(09)

Loan Discounts (Points) Paid Directly by Borrower (See instructions) ......................................

00

(10)

1) Total home mortgage interest paid ..................................................................................

00

(11)

2) Limit (Multiply the sum of line 4, Columns B and C of this Schedule and line 1, Part III

00

of Schedule IE Individual by 30% and enter here) ..............................................................

(12)

3) Allowable deduction for mortgage interest (Enter the smaller of lines A(1) and A(2).

If the total interest does not exceed 30% of the income for any of the 3 previous years, fill in

here

1)

(See instructions) .....................................................................................

00

(13)

(14)

00

B)

Casualty loss on your principal residence (See instructions) .......................................................

(15)

00

Medical expenses (Schedule A Individual, Part III, line 3) ........................................................

C)

(16)

00

Charitable contributions (Schedule A Individual, Part III, line 8) ................................................

(17)

D)

00

E)

Loss of personal property as a result of certain casualties (See instructions) .........................

(18)

B - TAXPAYER

C - SPOUSE

00

F)

Total deductions allocated in half (50%) of the total (Add lines 5A through 5E) ....................

(19)

00

00

G)

Enter 50% of the total on line 5F in Columns B and C .................................................................................

(21)

(20)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2