Schedule Co Individual - Optional Computation Of Tax - 2008

ADVERTISEMENT

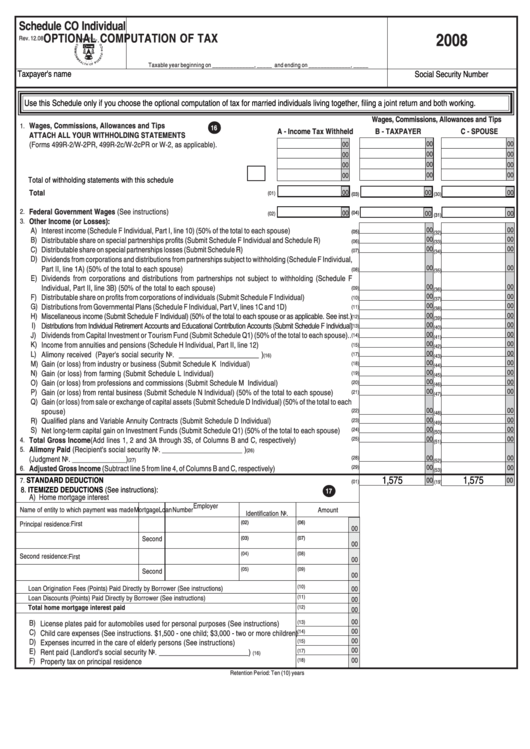

Schedule CO Individual

2008

OPTIONAL COMPUTATION OF TAX

Rev. 12.08

Taxable year beginning on ______________, _____ and ending on ______________, _____

Taxpayer's name

Social Security Number

Use this Schedule only if you choose the optional computation of tax for married individuals living together, filing a joint return and both working.

Wages, Commissions, Allowances and Tips

Wages, Commissions, Allowances and Tips

1.

16

A - Income Tax Withheld

B - TAXPAYER

C - SPOUSE

ATTACH ALL YOUR WITHHOLDING STATEMENTS

00

(Forms 499R-2/W-2PR, 499R-2c/W-2cPR or W-2, as applicable).

00

00

00

00

00

00

00

00

00

00

00

Total of withholding statements with this schedule ......................................

Total ........................................................................................................................

00

00

00

(01)

(03)

(30)

Federal Government Wages (See instructions)

.....................................................

2.

00

00

00

(04)

(02)

(31)

Other Income (or Losses):

3.

A)

00

00

Interest income (Schedule F Individual, Part I, line 10) (50% of the total to each spouse).................................

(05)

(32)

00

00

B)

Distributable share on special partnerships profits (Submit Schedule F Individual and Schedule R) ................

(06)

(33)

C)

00

00

Distributable share on special partnerships losses (Submit Schedule R) ..........................................................

(07)

(34)

D)

Dividends from corporations and distributions from partnerships subject to withholding (Schedule F Individual,

00

00

Part II, line 1A) (50% of the total to each spouse) ..........................................................................................

(08)

(35)

E)

Dividends from corporations and distributions from partnerships not subject to withholding (Schedule F

00

00

Individual, Part II, line 3B) (50% of the total to each spouse).........................................................................

(09)

(36)

00

00

F)

Distributable share on profits from corporations of individuals (Submit Schedule F Individual) .........................

(10)

(37)

00

00

G)

Distributions from Governmental Plans (Schedule F Individual, Part V, lines 1C and 1D) ..................................

(11)

(38)

H)

00

00

Miscellaneous income (Submit Schedule F Individual) (50% of the total to each spouse or as applicable. See inst.)

(12)

(39)

00

00

I)

Distributions from Individual Retirement Accounts and Educational Contribution Accounts (Submit Schedule F Individual)

(13)

(40)

J)

00

00

Dividends from Capital Investment or Tourism Fund (Submit Schedule Q1) (50% of the total to each spouse)..

(14)

(41)

00

00

K)

Income from annuities and pensions (Schedule H Individual, Part II, line 12) .................................................

(15)

(42)

00

L)

Alimony received (Payer's social security No. _________________________ )

.........................................

00

(17)

(16)

(43)

M)

00

00

Gain (or loss) from industry or business (Submit Schedule K Individual) ......................................................

(18)

(44)

00

00

N)

Gain (or loss) from farming (Submit Schedule L Individual) .........................................................................

(19)

(45)

O)

00

00

Gain (or loss) from professions and commissions (Submit Schedule M Individual) .......................................

(20)

(46)

00

00

P)

Gain (or loss) from rental business (Submit Schedule N Individual) (50% of the total to each spouse)..........

(21)

(47)

Q)

Gain (or loss) from sale or exchange of capital assets (Submit Schedule D Individual) (50% of the total to each

00

00

spouse) ................................................................................................................................................

(22)

(48)

00

R)

Qualified plans and Variable Annuity Contracts (Submit Schedule D Individual) ..........................................

00

(23)

(49)

S)

00

00

Net long-term capital gain on Investment Funds (Submit Schedule Q1) (50% of the total to each spouse) .....

(24)

(50)

00

00

Total Gross Income (Add lines 1, 2 and 3A through 3S, of Columns B and C, respectively) ...........................

4.

(25)

(51)

5.

Alimony Paid (Recipient's social security No. _________________________ )

(26)

00

00

(Judgment No. _______________)

..................................................................................................................

(28)

(27)

(52)

00

00

6.

Adjusted Gross Income (Subtract line 5 from line 4, of Columns B and C, respectively) ........................................

(29)

(53)

1,575

1,575

STANDARD DEDUCTION ....................................................................................................................................

7.

00

00

(01)

(19)

8. ITEMIZED DEDUCTIONS (See instructions):

17

A) Home mortgage interest

Employer

Name of entity to which payment was made Mortgage

Loan Number

Amount

Identification No.

(02)

(06)

Principal residence:

First

00

Second

(03)

(07)

00

(04)

(08)

Second residence:

First

00

(05)

(09)

Second

00

(10)

Loan Origination Fees (Points) Paid Directly by Borrower (See instructions) ..........................................

00

(11)

Loan Discounts (Points) Paid Directly by Borrower (See instructions) .....................................................

00

Total home mortgage interest paid ......................................................................................................

(12)

00

00

B)

License plates paid for automobiles used for personal purposes (See instructions) ........

(13)

00

C)

Child care expenses (See instructions. $1,500 - one child; $3,000 - two or more children)

(14)

00

D)

Expenses incurred in the care of elderly persons (See instructions) ................................

(15)

00

E)

Rent paid (Landlord's social security No. _________________________)

................

(17)

(16)

F)

00

Property tax on principal residence .................................................................................

(18)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2