New York City Tax Amnesty Nonfiler Questionnaire - Department Of Finance - 2004

ADVERTISEMENT

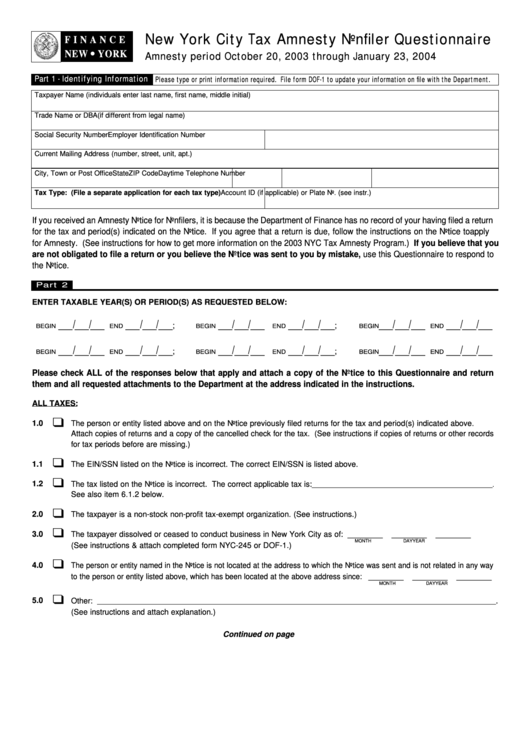

New York City Tax Amnesty Nonfiler Questionnaire

F I N A N C E

NEW YORK

Amnesty period October 20, 2003 through January 23, 2004

Part 1 - Identifying Information

Please type or print information required. File form DOF-1 to update your information on file with the Department.

Taxpayer Name (individuals enter last name, first name, middle initial)

Trade Name or DBA (if different from legal name)

Social Security Number

Employer Identification Number

Current Mailing Address (number, street, unit, apt.)

City, Town or Post Office

State

ZIP Code

Daytime Telephone Number

Tax Type: (File a separate application for each tax type)

Account ID (if applicable) or Plate No. (see instr.)

If you received an Amnesty Notice for Nonfilers, it is because the Department of Finance has no record of your having filed a return

for the tax and period(s) indicated on the Notice. If you agree that a return is due, follow the instructions on the Notice to apply

for Amnesty. (See instructions for how to get more information on the 2003 NYC Tax Amnesty Program.) If you believe that you

are not obligated to file a return or you believe the Notice was sent to you by mistake, use this Questionnaire to respond to

the Notice.

Par t 2

ENTER TAXABLE YEAR(S) OR PERIOD(S) AS REQUESTED BELOW:

__/__/__

__/__/__

__/__/__

__/__/__

__/__/__

__/__/__

;

;

BEGIN

END

BEGIN

END

BEGIN

END

__/__/__

__/__/__

__/__/__

__/__/__

__/__/__

__/__/__

;

;

BEGIN

END

BEGIN

END

BEGIN

END

Please check ALL of the responses below that apply and attach a copy of the Notice to this Questionnaire and return

them and all requested attachments to the Department at the address indicated in the instructions.

ALL TAXES:

1.0

The person or entity listed above and on the Notice previously filed returns for the tax and period(s) indicated above.

Attach copies of returns and a copy of the cancelled check for the tax. (See instructions if copies of returns or other records

for tax periods before are missing.)

1.1

The EIN/SSN listed on the Notice is incorrect. The correct EIN/SSN is listed above.

1.2

The tax listed on the Notice is incorrect. The correct applicable tax is:

_____________________________________________________.

See also item 6.1.2 below.

2.0

The taxpayer is a non-stock non-profit tax-exempt organization. (See instructions.)

3.0

The taxpayer dissolved or ceased to conduct business in New York City as of: ________

________

________

MONTH

DAY

YEAR

(See instructions & attach completed form NYC-245 or DOF-1.)

4.0

The person or entity named in the Notice is not located at the address to which the Notice was sent and is not related in any way

to the person or entity listed above, which has been located at the above address since: ________

________

________

MONTH

DAY

YEAR

5.0

Other:

.

_____________________________________________________________________________________________________________________

(See instructions and attach explanation.)

Continued on page 2...

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2