Form It 1 - Declaration - City Of Allentown

ADVERTISEMENT

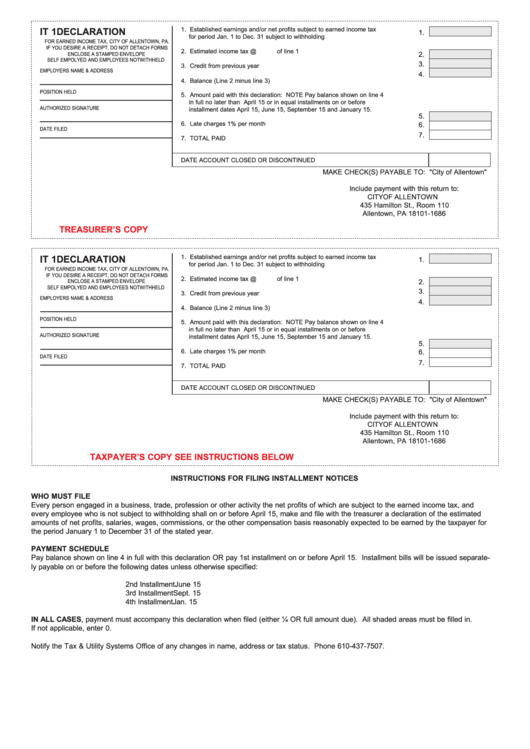

IT 1

DECLARATION

1. Established earnings and/or net profits subject to earned income tax

1.

for period Jan. 1 to Dec. 31 subject to withholding

FOR EARNED INCOME TAX, CITY OF ALLENTOWN, PA.

IF YOU DESIRE A RECEIPT, DO NOT DETACH FORMS

2. Estimated income tax @

of line 1

2.

ENCLOSE A STAMPED ENVELOPE

SELF EMPOLYED AND EMPLOYEES NOT WITHHELD

3.

3. Credit from previous year

EMPLOYERS NAME & ADDRESS

4.

4. Balance (Line 2 minus line 3)

POSITION HELD

5. Amount paid with this declaration: NOTE Pay balance shown on line 4

in full no later than April 15 or in equal installments on or before

AUTHORIZED SIGNATURE

installment dates April 15, June 15, September 15 and January 15.

5.

6. Late charges 1% per month

6.

DATE FILED

7.

7. TOTAL PAID

DATE ACCOUNT CLOSED OR DISCONTINUED

MAKE CHECK(S) PAYABLE TO: "City of Allentown"

Include payment with this return to:

CITY OF ALLENTOWN

435 Hamilton St., Room 110

Allentown, PA 18101-1686

TREASURER’S COPY

IT 1

DECLARATION

1. Established earnings and/or net profits subject to earned income tax

1.

for period Jan. 1 to Dec. 31 subject to withholding

FOR EARNED INCOME TAX, CITY OF ALLENTOWN, PA.

IF YOU DESIRE A RECEIPT, DO NOT DETACH FORMS

2. Estimated income tax @

of line 1

2.

ENCLOSE A STAMPED ENVELOPE

SELF EMPOLYED AND EMPLOYEES NOT WITHHELD

3.

3. Credit from previous year

EMPLOYERS NAME & ADDRESS

4.

4. Balance (Line 2 minus line 3)

POSITION HELD

5. Amount paid with this declaration: NOTE Pay balance shown on line 4

in full no later than April 15 or in equal installments on or before

AUTHORIZED SIGNATURE

installment dates April 15, June 15, September 15 and January 15.

5.

6. Late charges 1% per month

6.

DATE FILED

7.

7. TOTAL PAID

DATE ACCOUNT CLOSED OR DISCONTINUED

MAKE CHECK(S) PAYABLE TO: "City of Allentown"

Include payment with this return to:

CITY OF ALLENTOWN

435 Hamilton St., Room 110

Allentown, PA 18101-1686

TAXPAYER’S COPY SEE INSTRUCTIONS BELOW

INSTRUCTIONS FOR FILING INSTALLMENT NOTICES

WHO MUST FILE

Every person engaged in a business, trade, profession or other activity the net profits of which are subject to the earned income tax, and

every employee who is not subject to withholding shall on or before April 15, make and file with the treasurer a declaration of the estimated

amounts of net profits, salaries, wages, commissions, or the other compensation basis reasonably expected to be earned by the taxpayer for

the period January 1 to December 31 of the stated year.

PAYMENT SCHEDULE

Pay balance shown on line 4 in full with this declaration OR pay 1st installment on or before April 15. Installment bills will be issued separate-

ly payable on or before the following dates unless otherwise specified:

2nd Installment

June 15

3rd Installment

Sept. 15

4th Installment

Jan. 15

IN ALL CASES, payment must accompany this declaration when filed (either ¼ OR full amount due). All shaded areas must be filled in.

If not applicable, enter 0.

Notify the Tax & Utility Systems Office of any changes in name, address or tax status. Phone 610-437-7507.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1