Instructions For Form Ct-1 - Employer'S Annual Railroad Retirement Tax Return - 2004

ADVERTISEMENT

04

2 0

Department of the Treasury

Internal Revenue Service

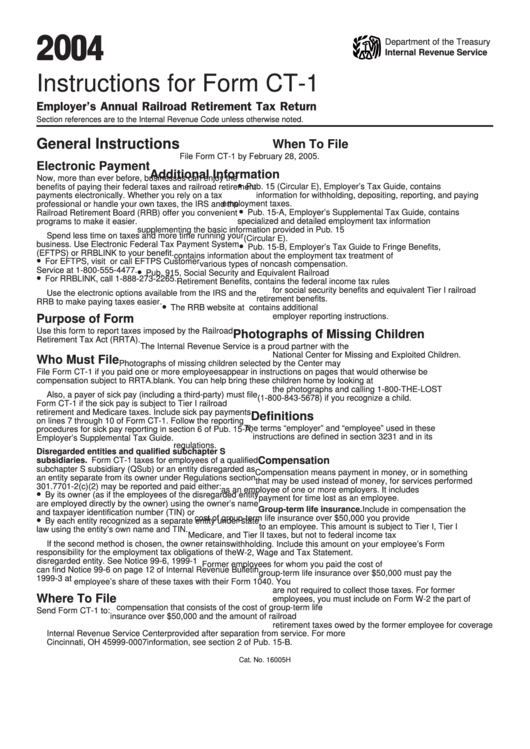

Instructions for Form CT-1

Employer’s Annual Railroad Retirement Tax Return

Section references are to the Internal Revenue Code unless otherwise noted.

General Instructions

When To File

File Form CT-1 by February 28, 2005.

Electronic Payment

Additional Information

Now, more than ever before, businesses can enjoy the

•

Pub. 15 (Circular E), Employer’s Tax Guide, contains

benefits of paying their federal taxes and railroad retirement

information for withholding, depositing, reporting, and paying

payments electronically. Whether you rely on a tax

employment taxes.

professional or handle your own taxes, the IRS and the

•

Pub. 15-A, Employer’s Supplemental Tax Guide, contains

Railroad Retirement Board (RRB) offer you convenient

programs to make it easier.

specialized and detailed employment tax information

supplementing the basic information provided in Pub. 15

Spend less time on taxes and more time running your

(Circular E).

•

business. Use Electronic Federal Tax Payment System

Pub. 15-B, Employer’s Tax Guide to Fringe Benefits,

(EFTPS) or RRBLINK to your benefit.

contains information about the employment tax treatment of

•

For EFTPS, visit or call EFTPS Customer

various types of noncash compensation.

•

Service at 1-800-555-4477.

Pub. 915, Social Security and Equivalent Railroad

•

For RRBLINK, call 1-888-273-2265.

Retirement Benefits, contains the federal income tax rules

for social security benefits and equivalent Tier I railroad

Use the electronic options available from the IRS and the

retirement benefits.

RRB to make paying taxes easier.

•

The RRB website at contains additional

employer reporting instructions.

Purpose of Form

Use this form to report taxes imposed by the Railroad

Photographs of Missing Children

Retirement Tax Act (RRTA).

The Internal Revenue Service is a proud partner with the

National Center for Missing and Exploited Children.

Who Must File

Photographs of missing children selected by the Center may

File Form CT-1 if you paid one or more employees

appear in instructions on pages that would otherwise be

compensation subject to RRTA.

blank. You can help bring these children home by looking at

the photographs and calling 1-800-THE-LOST

Also, a payer of sick pay (including a third-party) must file

(1-800-843-5678) if you recognize a child.

Form CT-1 if the sick pay is subject to Tier I railroad

retirement and Medicare taxes. Include sick pay payments

Definitions

on lines 7 through 10 of Form CT-1. Follow the reporting

The terms “employer” and “employee” used in these

procedures for sick pay reporting in section 6 of Pub. 15-A,

instructions are defined in section 3231 and in its

Employer’s Supplemental Tax Guide.

regulations.

Disregarded entities and qualified subchapter S

Compensation

subsidiaries. Form CT-1 taxes for employees of a qualified

subchapter S subsidiary (QSub) or an entity disregarded as

Compensation means payment in money, or in something

an entity separate from its owner under Regulations section

that may be used instead of money, for services performed

301.7701-2(c)(2) may be reported and paid either:

as an employee of one or more employers. It includes

•

By its owner (as if the employees of the disregarded entity

payment for time lost as an employee.

are employed directly by the owner) using the owner’s name

Group-term life insurance. Include in compensation the

and taxpayer identification number (TIN) or

•

cost of group-term life insurance over $50,000 you provide

By each entity recognized as a separate entity under state

to an employee. This amount is subject to Tier I, Tier I

law using the entity’s own name and TIN.

Medicare, and Tier II taxes, but not to federal income tax

If the second method is chosen, the owner retains

withholding. Include this amount on your employee’s Form

responsibility for the employment tax obligations of the

W-2, Wage and Tax Statement.

disregarded entity. See Notice 99-6, 1999-1 C.B. 321. You

Former employees for whom you paid the cost of

can find Notice 99-6 on page 12 of Internal Revenue Bulletin

group-term life insurance over $50,000 must pay the

1999-3 at

employee’s share of these taxes with their Form 1040. You

are not required to collect those taxes. For former

Where To File

employees, you must include on Form W-2 the part of

compensation that consists of the cost of group-term life

Send Form CT-1 to:

insurance over $50,000 and the amount of railroad

retirement taxes owed by the former employee for coverage

Internal Revenue Service Center

provided after separation from service. For more

Cincinnati, OH 45999-0007

information, see section 2 of Pub. 15-B.

Cat. No. 16005H

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7