Instructions For Form Ct-1 - Employer'S Annual Railroad Retirement Tax Return - 2001

ADVERTISEMENT

2

Form CT-1 (2001)

Page

Part II

Record of Railroad Retirement Tax Liability

Changes To Note

If you were a semiweekly schedule depositor during any part

of the year or you accumulated $100,000 or more on any day

during a deposit period, you must complete Form 945-A, Annual

Third Party Designee

Record of Federal Tax Liability. Do not complete the monthly

You can now allow an employee or paid preparer to resolve

summary below.

certain tax issues with the IRS. See Third Party Designee on

On Form 945-A for each payday, enter the sum of your

page 6 of the separate instructions for more information.

employee and employer Tier I and Tier II taxes on the

Threshold for Deposit Requirement Increased to

appropriate line. Enter your monthly supplemental annuity

$2,500

work-hour tax on the “ST” line for each month on Form 945-A.

Enter your special supplemental annuity tax from Forms G-241

Beginning with your 2001 Form CT-1, if your total taxes for the

to the right of the monthly title of the 3rd month of each quarter

year (line 18) are less than $2,500, you are not required to make

just above line 17, and write “SST” to the left of this title just

deposits. You may pay the total taxes with Form CT-1.

above line 1. Total the amounts for the months from lines A

through L, including the “ST” and “SST” amounts. Enter the total

Instructions

on line M, Form 945-A.

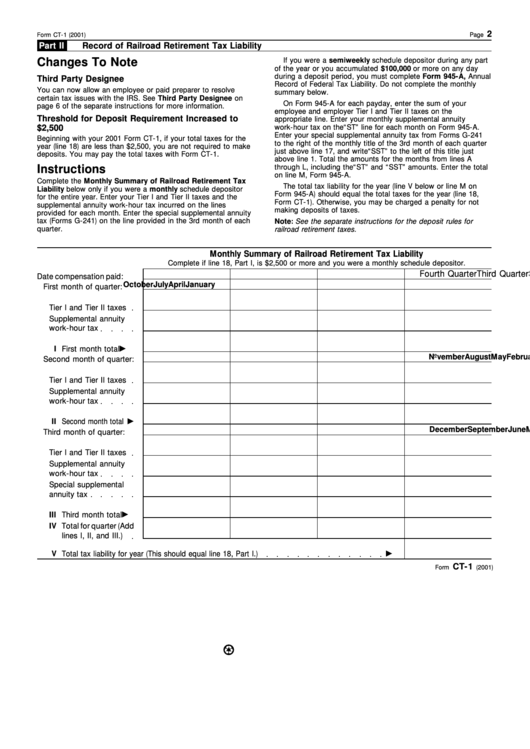

Complete the Monthly Summary of Railroad Retirement Tax

The total tax liability for the year (line V below or line M on

Liability below only if you were a monthly schedule depositor

Form 945-A) should equal the total taxes for the year (line 18,

for the entire year. Enter your Tier I and Tier II taxes and the

Form CT-1). Otherwise, you may be charged a penalty for not

supplemental annuity work-hour tax incurred on the lines

making deposits of taxes.

provided for each month. Enter the special supplemental annuity

tax (Forms G-241) on the line provided in the 3rd month of each

Note: See the separate instructions for the deposit rules for

quarter.

railroad retirement taxes.

Monthly Summary of Railroad Retirement Tax Liability

Complete if line 18, Part I, is $2,500 or more and you were a monthly schedule depositor.

First Quarter

Second Quarter

Third Quarter

Fourth Quarter

Date compensation paid:

January

April

July

October

First month of quarter:

Tier I and Tier II taxes

Supplemental annuity

work-hour tax

I

First month total

February

May

August

November

Second month of quarter:

Tier I and Tier II taxes

Supplemental annuity

work-hour tax

II

Second month total

March

June

September

December

Third month of quarter:

Tier I and Tier II taxes

Supplemental annuity

work-hour tax

Special supplemental

annuity tax

III Third month total

IV Total for quarter (Add

lines I, II, and III.)

V Total tax liability for year (This should equal line 18, Part I.)

CT-1

Form

(2001)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7