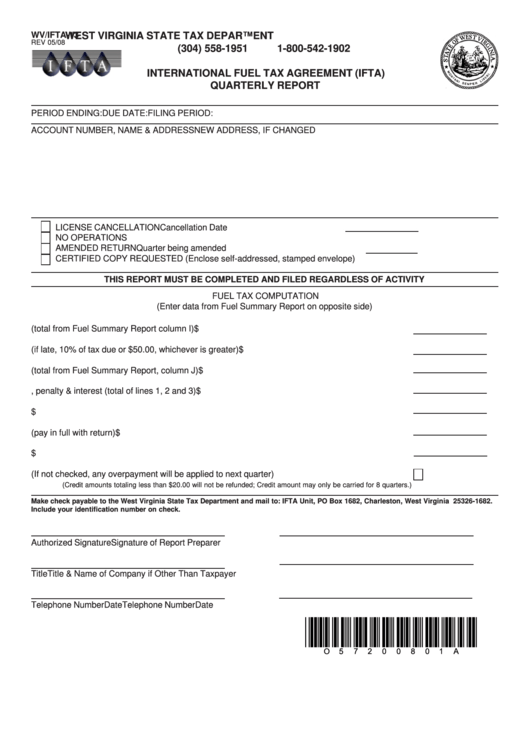

Form Wv/ifta-13 - International Fuel Tax Agreement (Ifta) Quarterly Report

ADVERTISEMENT

WV/IFTA-13

WEST VIRGINIA STATE TAX DEPARTMENT

REV 05/08

(304) 558-1951

1-800-542-1902

INTERNATIONAL FUEL TAX AGREEMENT (IFTA)

QUARTERLY REPORT

PERIOD ENDING:

DUE DATE:

FILING PERIOD:

ACCOUNT NUMBER, NAME & ADDRESS

NEW ADDRESS, IF CHANGED

LICENSE CANCELLATION

Cancellation Date

NO OPERATIONS

AMENDED RETURN

Quarter being amended

CERTIFIED COPY REQUESTED (Enclose self-addressed, stamped envelope)

THIS REPORT MUST BE COMPLETED AND FILED REGARDLESS OF ACTIVITY

FUEL TAX COMPUTATION

(Enter data from Fuel Summary Report on opposite side)

1.

Tax due or credit (total from Fuel Summary Report column I)

$

2.

Penalty (if late, 10% of tax due or $50.00, whichever is greater)

$

3.

Interest (total from Fuel Summary Report, column J)

$

4.

Total tax due or credit, penalty & interest (total of lines 1, 2 and 3)

$

5.

Previous balance due or credit

$

6.

BALANCE DUE (pay in full with return)

$

7.

CREDIT DUE

$

8.

REFUND REQUESTED (If not checked, any overpayment will be applied to next quarter)

(Credit amounts totaling less than $20.00 will not be refunded; Credit amount may only be carried for 8 quarters.)

Make check payable to the West Virginia State Tax Department and mail to: IFTA Unit, PO Box 1682, Charleston, West Virginia 25326-1682.

Include your identification number on check.

Authorized Signature

Signature of Report Preparer

Title

Title & Name of Company if Other Than Taxpayer

Telephone Number

Date

Telephone Number

Date

*O57200801A*

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4