Form Ifta-1 - International Fuel Tax Agreement (Ifta) - 2001

ADVERTISEMENT

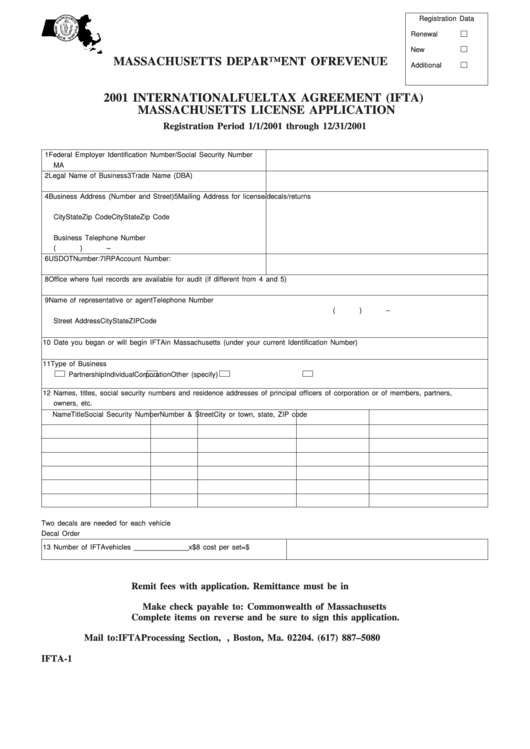

Registration Data

Renewal

New

MASSACHUSETTS DEPARTMENT OF REVENUE

Additional

2001 INTERNATIONAL FUEL TAX AGREEMENT (IFTA)

MASSACHUSETTS LICENSE APPLICATION

Registration Period 1/1/2001 through 12/31/2001

1 Federal Employer Identification Number/Social Security Number

MA

2 Legal Name of Business

3 Trade Name (DBA)

4 Business Address (Number and Street)

5 Mailing Address for license/decals/returns

City

State

Zip Code

City

State

Zip Code

Business Telephone Number

(

)

–

6 USDOT Number:

7 IRP Account Number:

8 Office where fuel records are available for audit (if different from 4 and 5)

9 Name of representative or agent

Telephone Number

(

)

–

Street Address

City

State

ZIP Code

10 Date you began or will begin IFTA in Massachusetts (under your current Identification Number)

11 Type of Business

Partnership

Individual

Corporation

Other (specify)

12 Names, titles, social security numbers and residence addresses of principal officers of corporation or of members, partners,

owners, etc.

Name

Title

Social Security Number

Number & Street

City or town, state, ZIP code

Two decals are needed for each vehicle

Decal Order

13 Number of IFTA vehicles ______________ x $8 cost per set =

$

Remit fees with application. Remittance must be in U.S. funds.

Make check payable to: Commonwealth of Massachusetts

Complete items on reverse and be sure to sign this application.

Mail to: IFTA Processing Section, P.O. BOX 7027, Boston, Ma. 02204. (617) 887–5080

IFTA-1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4