Print and Reset Form

Reset Form

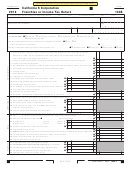

Schedule F

Computation of Trade or Business Income. See instructions.

1

a) Gross receipts or sales _______________ b) Less returns and allowances ________________ c) Balance

1c

2

Cost of goods sold from Schedule V, line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3

Gross profit. Subtract line 2 from line 1c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4

Net gain (loss). Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

¼ ¼ ¼ ¼ ¼

5

Other income (loss). Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6

Total income (loss). Combine line 3 through line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7

Compensation of officers. Attach schedule. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

¼ ¼ ¼ ¼ ¼

8

Salaries and wages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9

Repairs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10

Bad debts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

¼ ¼ ¼ ¼ ¼

11

Rents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12

Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13

Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

¼ ¼ ¼ ¼ ¼

14

a) Depreciation ____________ b) Less depreciation reported elsewhere on return ____________ Balance

14

15

Depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

16

Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

17

Pension, profit-sharing plans, etc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

18

Employee benefit programs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

19

a) Total travel and entertainment _______________________________ b) Deductible amount . . . . . . . . . . . .

19b

¼ ¼ ¼ ¼ ¼

20

Other deductions. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

¼ ¼ ¼ ¼ ¼

21

Total deductions. Add line 7 through line 20 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

¼ ¼ ¼ ¼ ¼

22

Ordinary income (loss) from trade or business. Subtract line 21 from line 6. Enter here and on Side 1, line 1

22

Schedule V Cost of Goods Sold

1 Inventory at beginning of year . . . . . . . . . . . . .

5 Other costs. Attach schedule . . . . . . . . . . . . . . .

¼

2 Purchases . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Total. Add line 1 through line 5 . . . . . . . . . . . . .

¼

3 Cost of labor . . . . . . . . . . . . . . . . . . . . . . . . . .

7 Inventory at end of year . . . . . . . . . . . . . . . . . .

¼

¼

4 Other IRC Sec. 263A costs. Attach schedule .

8 Cost of goods sold. Subtract line 7 from line 6

Was there any substantial change in the manner of determining quantities, costs, or valuations between opening and closing inventory? . . . . . . .

Yes

No

If “Yes,’’ attach an explanation. Enter California seller’s permit number, if any

_____________________ Method of inventory valuation _________________

¼

Check if the LIFO inventory method was adopted this taxable year for any goods. If checked, attach federal Form 970 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

¼

If the LIFO inventory method was used for this taxable year, enter the amount of closing inventory computed under LIFO . . . . . . . .

____________________

Schedule J

Add-On Taxes or Recapture of Tax Credits. See instructions.

¼

1 LIFO recapture due to S corporation election (IRC Sec. 1363(d) deferral: $__________________) . . . . . . . . . . . . . . . . .

1

¼

2 Interest computed under the look-back method for completed long-term contracts (attach form FTB 3834) . . . . . . . . . .

2

¼

3 Interest on tax attributable to installment: a) Sales of certain timeshares and residential lots . . . . . . . . . . . . . . . . . . . . .

3a

¼

b) Method for nondealer installment obligations . . . . . . . . . . . . . . . . . . . . . .

3b

¼

4 IRC Section 197(f)(9)(B)(ii) election . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

¼

5 Credit recapture name:________________________________________________________________ . . . . . . . . . . .

5

6 Combine line 1 through line 5. Revise the amount on Side 1, line 36 or line 37, whichever applies, by this amount.

¼

Write “Schedule J’’ to the left of line 36 or line 37 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

¼

¼

L Accounting method:

(1)

Cash (2)

Accrual (3)

Other

? . . .

E Does this tax return include Qualified Subchapter S Subsidiaries

Yes

No

¼

M Location of principal accounting records: ________________________________________

F Date incorporated:__________________

Where: State

Country____________

¼ __________________________________

G Maximum number of shareholders in the corporation at any time during

N “Doing business as’’ name:

¼

O Have all required information returns (e.g., federal Form 1099,

the year:

______________________

8300, etc.) been filed with the Franchise Tax Board? . . . . . . . . . . . .

N/A

Yes

No

H Date business began in California or date income was first derived from

P Is this corporation apportioning income to California using

¼

¼

California sources:

_______________________________________________

Schedule R? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

I

Is the corporation under audit by the IRS or has it been audited

Q Has the S corporation included a Reportable Transaction, Listed

¼

in a prior year? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Transaction or Registered Tax Shelter within this return? (See

¼

¼

instructions for definitions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

J Effective date of federal S election:

_______________________________________

If “Yes,” complete and attach Form 8886 or 8271 for each such transaction.

Under penalties of perjury, I declare that I have examined this tax return, including accompanying schedules and statements, and to the best of my knowledge and belief, it

Please

is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign

Signature of officer

Title

Date

Telephone

Here

¼

(

)

Paid preparer’s SSN/PTIN

Preparer’s signature

Date

Check if self-

¼

employed

Paid

FEIN

Telephone

Firm’s name

Preparer’s

-

(or yours, if

¼

¼

Use Only

(

)

self-employed)

and address

Side 2 Form 100S

2004

100S04203

C1

For Privacy Act Notice, get form FTB 1131.

1

1 2

2 3

3 4

4