Print and Reset Form

Reset Form

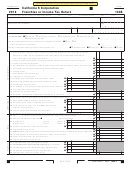

S Corporation Shareholders’ Shares of Income, Deductions, Credits, etc.

Schedule K

(d)

(b)

(c)

Total amount using

(a)

Amount from federal

California

California law.

Pro-rata share items

Schedule K (1120S)

adjustment

Combine (b) and (c)

where applicable

¼ ¼ ¼ ¼ ¼

1 Ordinary income (loss) from trade or business activities . . . . . . . . . . . . . . . . . .

¼ ¼ ¼ ¼ ¼

2 Net income (loss) from rental real estate activities. Attach federal Form 8825 .

3 a Gross income from other rental activities . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b Expenses from other rental activities. Attach schedule . . . . . . . . . . . . . . . . . .

¼ ¼ ¼ ¼ ¼

c Net income (loss) from other rental activities. Subtract line 3b from line 3a .

4 Portfolio income (loss):

¼ ¼ ¼ ¼ ¼

a Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

¼ ¼ ¼ ¼ ¼

b Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

¼ ¼ ¼ ¼ ¼

c Royalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

¼ ¼ ¼ ¼ ¼

d Net short-term capital gain (loss). Attach schedule D (100S) . . . . . . . . . . . .

¼ ¼ ¼ ¼ ¼

e Net long-term capital gain (loss). Attach Schedule D (100S) . . . . . . . . . . . . .

¼ ¼ ¼ ¼ ¼

f Other portfolio income (loss). Attach schedule . . . . . . . . . . . . . . . . . . . . . . . .

¼ ¼ ¼ ¼ ¼

5 Net gain (loss) under IRC Section 1231 (other than due to casualty or theft) . .

¼ ¼ ¼ ¼ ¼

6 Other income (loss). Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

¼ ¼ ¼ ¼ ¼

7 Charitable contributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 Expense deduction for recovery property (R&TC Section 17267.2,

Section 17267.6, Section 17268, and IRC Section 179).

Attach Schedule B (100S) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

¼ ¼ ¼ ¼ ¼

9 Deductions related to portfolio income (loss). Attach schedule . . . . . . . . . . . . .

10 Other deductions. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

¼ ¼ ¼ ¼ ¼

11 a Interest expense on investment debts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b (1) Investment income included on line 4a, line 4b, line 4c, and line 4f . . . .

(2) Investment expenses included on line 9 above . . . . . . . . . . . . . . . . . . . . .

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

¼ ¼ ¼ ¼ ¼

12 a Low-income housing credit. See instructions. Attach schedule . . . . . . . . . . .

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

b Credits related to rental real estate activities other than on line 12(a).

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

¼ ¼ ¼ ¼ ¼

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

¼ ¼ ¼ ¼ ¼

c Credits related to other rental activities. See instructions. Attach schedule . .

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

¼ ¼ ¼ ¼ ¼

13 Other credits. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

14 a Depreciation adjustment on property placed in service after 12/31/86 . . . . .

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

b Adjusted gain or loss. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

c Depletion (other than oil and gas) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

d (1) Gross income from oil, gas, and geothermal properties . . . . . . . . . . . . .

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

(2) Deductions allocable to oil, gas, and geothermal properties . . . . . . . . . .

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

e Other adjustments and tax preference items. Attach schedule . . . . . . . . . . . .

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

15 a Type of income ________________________________________________

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

b Name of state _________________________________________________

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

c Total gross income from sources outside California. Attach schedule . . . . . .

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

d Total applicable deductions and losses. Attach schedule . . . . . . . . . . . . . . . .

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

¼ ¼ ¼ ¼ ¼

e Total other state taxes. Check one:

Paid

Accrued . . . . . . . . . . . . . . . .

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

16 a Total expenditures to which an IRC Section 59(e) election may apply . . . . . .

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1

b Type of expenditures ___________________________________________

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1

17 Tax-exempt interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

¼ ¼ ¼ ¼ ¼

18 Other tax-exempt income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19 Nondeductible expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20 Total property distributions (including cash) other than dividend

¼ ¼ ¼ ¼ ¼

distributions reported on line 22 below . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

21 Other items and amounts not included in line 1 through line 20 above that

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

¼ ¼ ¼ ¼ ¼

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

are required to be reported separately to shareholders. Attach schedule . . . . .

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

¼ ¼ ¼ ¼ ¼

22 Total dividend distributions paid from accumulated earnings and profits . . . . .

23 Income (loss) (required only if Schedule M-1 must be completed). Combine

line 1, line 2, and line 3c through line 6. From the result, subtract the sum

¼ ¼ ¼ ¼ ¼

of line 7 through line 11a and line 16a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

100S04303

Form 100S

2004 Side 3

C1

1

1 2

2 3

3 4

4