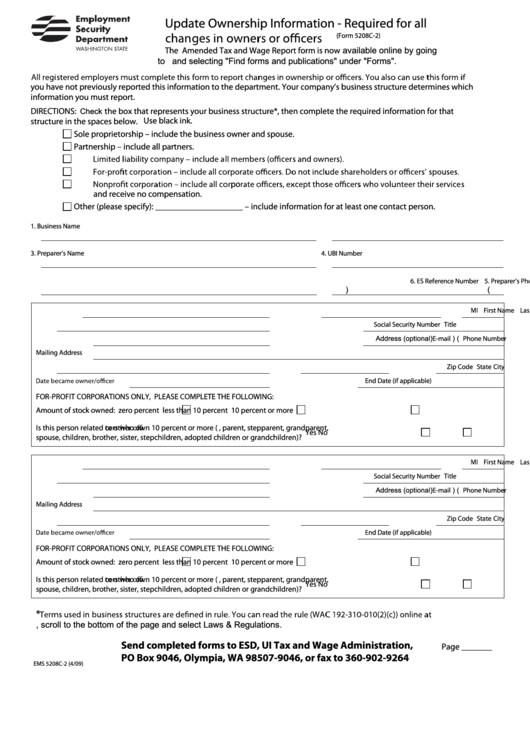

Update Ownership Information - Required for all

(Form 5208C-2)

The Amended Tax and Wage Report f orm is now available online by going

to and selecting "Find forms and publications" under "Forms".

you have not previously reported this information to the department. Your company’s business structure determines which

information you must report.

DIRECTIONS:

the box that represents your business structure*, then complete the required information for that

Check

Use black ink.

structure in the spaces below.

Sole proprietorship – include the business owner and spouse.

Partnership – include all partners.

po

and receive no compensation.

Other (please specify): ____________________ – include information for at least one contact person.

1.

Business Name

2.

Federal ID Number

3.

Preparer’s Name

4.

UBI Number

5.

Preparer’s Phone

6.

ES Reference Number

(

)

Last Name

First Name

MI

Title

Social Security Number

(

)

Address (optional)

Phone Number

E-mail

Mailing Address

City

State

Zip Code

End Date (if applicable)

FOR-PROFIT CORPORATIONS ONLY, PLEASE COMPLETE THE FOLLOWING:

Amount of stock owned:

zero percent

less than 10 percent

10 percent or more

Is this person related

cers who own 10 percent or more (i.e., parent, stepparent, grandparent,

Yes

No

spouse, children, brother, sister, stepchildren, adopted children or grandchildren)?

Last Name

First Name

MI

Title

Social Security Number

(

)

Address (optional)

Phone Number

E-mail

Mailing Address

City

State

Zip Code

End Date (if applicable)

FOR-PROFIT CORPORATIONS ONLY, PLEASE COMPLETE THE FOLLOWING:

Amount of stock owned:

zero percent

less than 10 percent

10 percent or more

Is this person related

cers who own 10 percent or more (i.e., parent, stepparent, grandparent,

Yes

No

spouse, children, brother, sister, stepchildren, adopted children or grandchildren)?

*

, scroll to the bottom of the page and select Laws & Regulations.

Send completed forms to ESD, UI Tax and Wage Administration,

Page _______

PO Box 9046, Olympia, WA 98507-9046, or fax to 360-902-9264

EMS 5208C-2 (4/09)

1

1