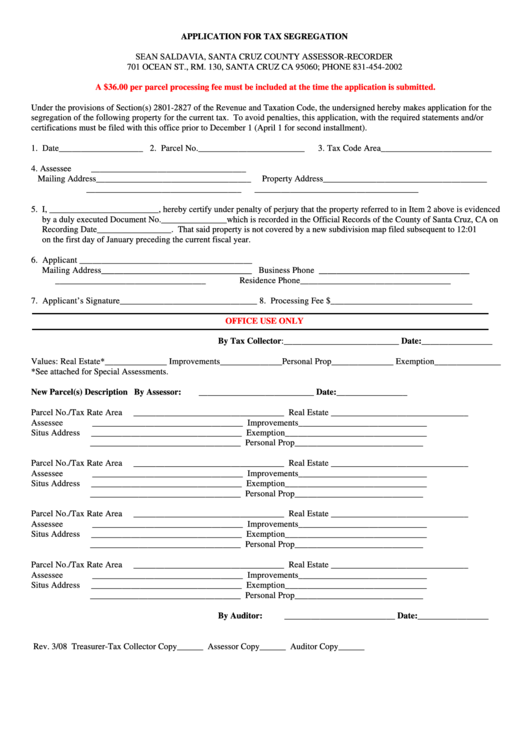

APPLICATION FOR TAX SEGREGATION

SEAN SALDAVIA, SANTA CRUZ COUNTY ASSESSOR-RECORDER

701 OCEAN ST., RM. 130, SANTA CRUZ CA 95060; PHONE 831-454-2002

A $36.00 per parcel processing fee must be included at the time the application is submitted.

Under the provisions of Section(s) 2801-2827 of the Revenue and Taxation Code, the undersigned hereby makes application for the

segregation of the following property for the current tax. To avoid penalties, this application, with the required statements and/or

certifications must be filed with this office prior to December 1 (April 1 for second installment).

1. Date___________________

2. Parcel No.________________________

3. Tax Code Area_________________________

4. Assessee

___________________________________

Mailing Address___________________________________

Property Address _____________________________________

___________________________________

_____________________________________

5. I, _________________________, hereby certify under penalty of perjury that the property referred to in Item 2 above is evidenced

by a duly executed Document No._______________which is recorded in the Official Records of the County of Santa Cruz, CA on

Recording Date_________________. That said property is not covered by a new subdivision map filed subsequent to 12:01 a.m.

on the first day of January preceding the current fiscal year.

6. Applicant _______________________________________

Mailing Address__________________________________

Business Phone __________________________________

__________________________________

Residence Phone__________________________________

7. Applicant’s Signature_______________________________

8. Processing Fee $________________________________

OFFICE USE ONLY

By Tax Collector:__________________________ Date:________________

Values: Real Estate*______________ Improvements______________Personal Prop______________ Exemption_______________

*See attached for Special Assessments.

New Parcel(s) Description

By Assessor:

__________________________ Date:________________

Parcel No./Tax Rate Area

__________________________________

Real Estate _______________________________

Assessee

__________________________________

Improvements_____________________________

Situs Address

__________________________________

Exemption________________________________

__________________________________

Personal Prop_____________________________

Parcel No./Tax Rate Area

__________________________________

Real Estate _______________________________

Assessee

__________________________________

Improvements_____________________________

Situs Address

__________________________________

Exemption________________________________

__________________________________

Personal Prop_____________________________

Parcel No./Tax Rate Area

__________________________________

Real Estate _______________________________

Assessee

__________________________________

Improvements_____________________________

Situs Address

__________________________________

Exemption________________________________

__________________________________

Personal Prop_____________________________

Parcel No./Tax Rate Area

__________________________________

Real Estate _______________________________

Assessee

__________________________________

Improvements_____________________________

Situs Address

__________________________________

Exemption________________________________

__________________________________

Personal Prop_____________________________

By Auditor:

_________________________ Date:________________

Rev. 3/08

Treasurer-Tax Collector Copy______

Assessor Copy______

Auditor Copy______

1

1 2

2