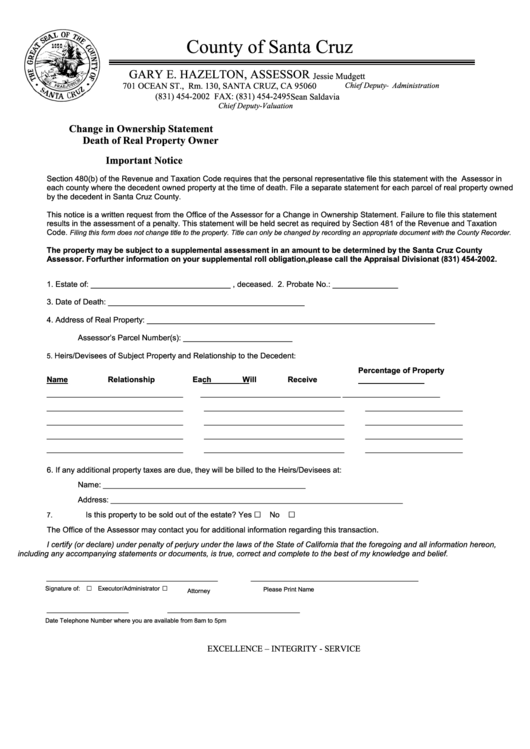

County of Santa Cruz

GARY E. HAZELTON, ASSESSOR

Jessie Mudgett

701 OCEAN ST., Rm. 130, SANTA CRUZ, CA 95060

Chief Deputy-Administration

(831) 454-2002 FAX: (831) 454-2495

Sean Saldavia

Chief Deputy-Valuation

Change in Ownership Statement

Death of Real Property Owner

Important Notice

Section 480(b) of the Revenue and Taxation Code requires that the personal representative file this statement with the Assessor in

each county where the decedent owned property at the time of death. File a separate statement for each parcel of real property owned

by the decedent in Santa Cruz County.

This notice is a written request from the Office of the Assessor for a Change in Ownership Statement. Failure to file this statement

results in the assessment of a penalty. This statement will be held secret as required by Section 481 of the Revenue and Taxation

Code.

Filing this form does not change title to the property. Title can only be changed by recording an appropriate document with the County Recorder.

The property may be subject to a supplemental assessment in an amount to be determined by the Santa Cruz County

Assessor. For further information on your supplemental roll obligation, please call the Appraisal Division at (831) 454-2002.

1.

Estate of: ________________________________ , deceased.

2.

Probate No.: _______________

3.

Date of Death: _____________________________________________

4.

Address of Real Property: __________________________________________________________________

Assessor’s Parcel Number(s): _________________________

Heirs/Devisees of Subject Property and Relationship to the Decedent

5.

:

Percentage of Property

Name

Relationship

Each Will Receive

___________________________________

____________________________________

_________________________

___________________________________

____________________________________

_________________________

___________________________________

____________________________________

_________________________

___________________________________

____________________________________

_________________________

___________________________________

____________________________________

_________________________

6.

If any additional property taxes are due, they will be billed to the Heirs/Devisees at:

Name:

____________________________________________________

Address:

___________________________________________________________________________

Is this property to be sold out of the estate? Yes

No

7.

The Office of the Assessor may contact you for additional information regarding this transaction.

I certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing and all information hereon,

including any accompanying statements or documents, is true, correct and complete to the best of my knowledge and belief.

____________________________________________

___________________________________________

Please Print Name

Signature of:

Executor/Administrator

Attorney

_____________________

__________________________________

Date

Telephone Number where you are available from 8am to 5pm

EXCELLENCE – INTEGRITY - SERVICE

1

1