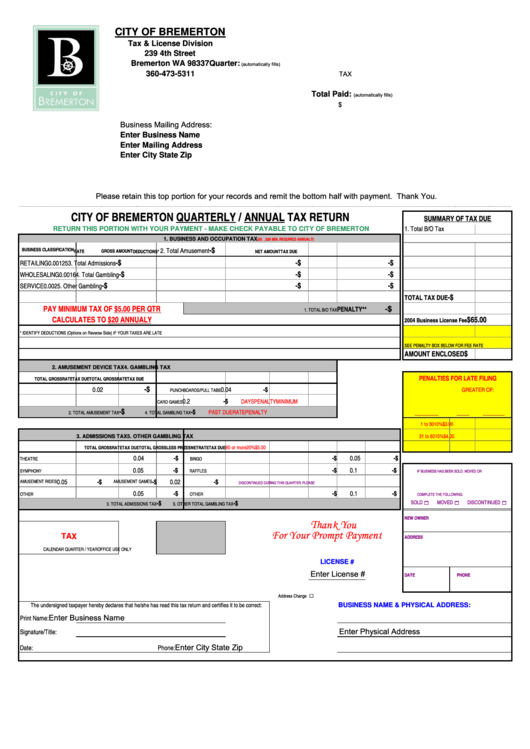

Quarterly / Annual Tax Return - City Of Bremerton

ADVERTISEMENT

CITY OF BREMERTON

Tax & License Division

239 4th Street

Bremerton WA 98337

Quarter:

(automatically fills)

TAX

360-473-5311

Total Paid:

(automatically fills)

$

Business Mailing Address:

Enter Business Name

Enter Mailing Address

Enter City State Zip

Please retain this top portion for your records and remit the bottom half with payment. Thank You.

CITY OF BREMERTON QUARTERLY / ANNUAL TAX RETURN

SUMMARY OF TAX DUE

1. Total B/O Tax

RETURN THIS PORTION WITH YOUR PAYMENT - MAKE CHECK PAYABLE TO CITY OF BREMERTON

1. BUSINESS AND OCCUPATION TAX

($5 MIN.REQUIRED QTRLY, $20 MIN. REQUIRED ANNUALY)

$

-

BUSINESS CLASSIFICATION

2. Total Amusement

GROSS AMOUNT

DEDUCTIONS*

NET AMOUNT

RATE

TAX DUE

$

-

$

-

$

-

RETAILING

0.00125

3. Total Admissions

$

-

$

-

$

-

WHOLESALING

0.0016

4. Total Gambling

$

-

$

-

$

-

SERVICE

0.002

5. Other Gambling

$

-

TOTAL TAX DUE

PAY MINIMUM TAX OF $5.00 PER QTR

PENALTY**

$

-

1. TOTAL B/O TAX

CALCULATES TO $20 ANNUALY

$65.00

2004 Business License Fee

* IDENTIFY DEDUCTIONS (Options on Reverse Side)

IF YOUR TAXES ARE LATE

SEE PENALTY BOX BELOW FOR FEE RATE

$

AMOUNT ENCLOSED

2. AMUSEMENT DEVICE TAX

4. GAMBLING TAX

PENALTIES FOR LATE FILING

TOTAL GROSS

RATE

TAX DUE

TOTAL GROSS

RATE

TAX DUE

$

-

0.02

0.04

$

-

GREATER OF:

PUNCHBOARDS/PULL TABS

0.2

$

-

DAYS

PENALTY

MINIMUM

CARD GAMES

$

-

$

-

PAST DUE

RATE

PENALTY

2. TOTAL AMUSEMENT TAX

4. TOTAL GAMBLING TAX

1 to 30

10%

$3.00

31 to 60

15%

$4.00

3. ADMISSIONS TAX

5. OTHER GAMBLING TAX

60 or more

20%

$5.00

TOTAL GROSS

RATE

TAX DUE

TOTAL GROSS

LESS PRIZES

NET

RATE

TAX DUE

0.04

$

-

$

-

0.05

$

-

THEATRE

BINGO

0.05

$

-

$

-

0.1

$

-

SYMPHONY

RAFFLES

IF BUSINESS HAS BEEN SOLD. MOVED OR

0.05

$

-

$

-

0.02

$

-

AMUSEMENT RIDES

AMUSEMENT GAMES

DISCONTINUED DURING THIS QUARTER, PLEASE

0.05

$

-

$

-

0.1

$

-

OTHER

OTHER

COMPLETE THE FOLLOWING:

$

-

$

-

SOLD

MOVED

DISCONTINUED

3. TOTAL ADMISSIONS TAX

5. OTHER TOTAL GAMBLING TAX

NEW OWNER

Thank You

For Your Prompt Payment

TAX

ADDRESS

CALENDAR QUARTER / YEAR

OFFICE USE ONLY

LICENSE #

Enter License #

DATE

PHONE

□

Address Change

The undersigned taxpayer hereby declares that he/she has read this tax return and certifies it to be correct:

BUSINESS NAME & PHYSICAL ADDRESS:

Enter Business Name

Print Name:

Enter Physical Address

Signature/Title:

Enter City State Zip

Date:

Phone:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1