Quarterly Sales Tax Return - City Of Larsen Bay

ADVERTISEMENT

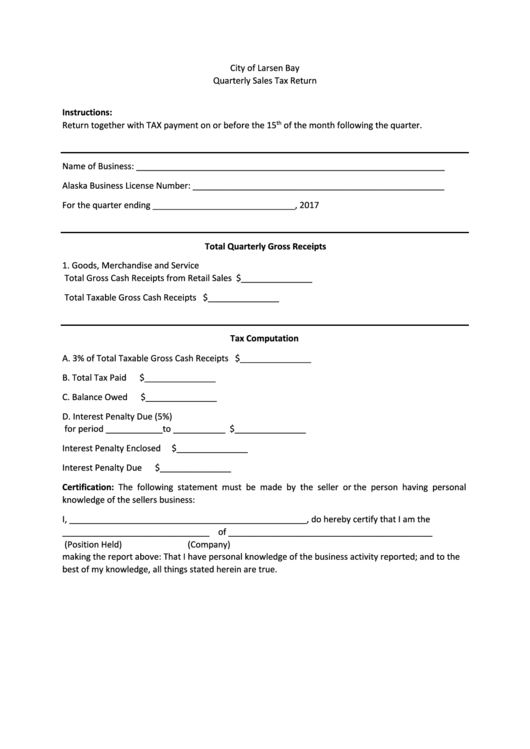

City of Larsen Bay

Quarterly Sales Tax Return

Instructions:

th

Return together with TAX payment on or before the 15

of the month following the quarter.

Name of Business: _________________________________________________________________

Alaska Business License Number: _____________________________________________________

For the quarter ending ______________________________, 2017

Total Quarterly Gross Receipts

1. Goods, Merchandise and Service

Total Gross Cash Receipts from Retail Sales

$_______________

Total Taxable Gross Cash Receipts

$_______________

Tax Computation

A. 3% of Total Taxable Gross Cash Receipts

$_______________

B. Total Tax Paid

$_______________

C. Balance Owed

$_______________

D. Interest Penalty Due (5%)

for period ____________to ___________

$_______________

Interest Penalty Enclosed

$_______________

Interest Penalty Due

$_______________

Certification: The following statement must be made by the seller or the person having personal

knowledge of the sellers business:

I, __________________________________________________, do hereby certify that I am the

_______________________________

of

___________________________________________

(Position Held)

(Company)

making the report above: That I have personal knowledge of the business activity reported; and to the

best of my knowledge, all things stated herein are true.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1