Form Lb-50 - Notice Of Property Tax And Certification Of Intent To Impose A Tax, Fee, Assessment, Or Charge On Property - 2004-2005 Page 2

ADVERTISEMENT

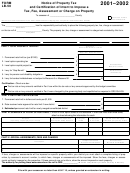

Worksheet for Allocating Bond Taxes

Bonds approved prior to October 6, 2001 (including advanced refunding issues):

Principal

Interest

Total

Bond Issue 1

Bond Issue 2

Bond Issue 3

Total A

Bonds approved after October 6, 2001 (including advanced refunding issues):

Principal

Interest

Total

Bond Issue 1

Bond Issue 2

Bond Issue 3

Total B

Total Bond (A + B)

Total Bonds

×

Total A

= $_____________

Allocation %

Bond Levy

=

=

$____________ (enter on line 6a on the front)

Total A + B = $_____________

____________%

$____________

×

Total B

= $_____________

Allocation %

Bond Levy

=

=

$____________ (enter on line 6b on the front)

Total A + B = $_____________

____________%

$____________

Total Bond Levy $

(enter on line 6c on the front)

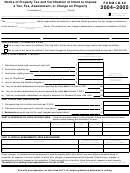

Example—Total Bond Levy = $5,000

Bonds approved prior to October 6, 2001 (including advanced refunding issues):

Principal

Interest

Total

5,000.00

500.00

5,500.00

Bond A:

Bond Issue 1

3,000.00

250.00

3,250.00

Bond Issue 2

1,000.00

100.00

1,100.00

Bond Issue 3

9,850.00

Total A

Bonds approved after October 6, 2001 (including advanced refunding issues):

Principal

Interest

Total

3,000.00

50.00

3,050.00

Bond B:

Bond Issue 1

3,050.00

Total B

$12,900.00

Total Bond (A + B)

Formula for determining the division of tax:

9,850.00

×

Total A

= $_____________

Allocation %

Bond Levy

=

=

3,818.00

$____________ (enter on line 6a on the front)

12,900.00

0.7636

5,000.00

Total A + B = $_____________

____________%

$____________

3,050.00

×

Total B

= $_____________

Allocation %

Bond Levy

=

=

1,182.00

$____________ (enter on line 6b on the front)

12,900.00

0.2364

5,000.00

Total A + B = $_____________

____________%

$____________

5,000.00

Total Bond Levy $

(enter on line 6c on the front)

150-504-050 back (Rev. 1-04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4