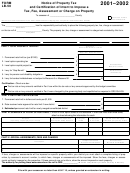

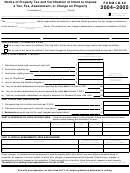

Form Lb-50 - Notice Of Property Tax And Certification Of Intent To Impose A Tax, Fee, Assessment, Or Charge On Property - 2004-2005 Page 4

ADVERTISEMENT

1. Ad valorem assessments.

Part II: Rate limit certification

2. Other taxes, fees, charges, and special assessments, such

Most districts had a permanent rate limit established in

as for water, irrigation, road, drainage, etc., which may

1997–98 for operating taxes. Some new districts have had

be placed on the roll.

permanent rate limits established by voters. Other districts

Taxing districts such as counties and cities may have

will have a new permanent rate because of a merger or con-

charges that fall into this area. Some special districts, such

solidation. Some taxing districts in Deschutes and Linn

as irrigation, water and some road districts, may also im-

Counties had their permanent rate authority reduced by

pose a special assessment on the properties within their

the 1999 legislature. The reduced rates were effective be-

boundaries. Some nongovernmental entities may also have

ginning in 2000–01.

specific statutory authority to place charges on the roll.

Part II of this form is designed to notify the assessor of your

These certified charges may be calculated on an ad valo-

permanent rate limit.

rem basis or on another unit of measurement, such as by

Line 7. Enter the district’s permanent rate limit per $1,000

property, acre, or frontage foot. Your options are usually

governed by statute.

of assessed value. The rate should be carried four places

to the right of the decimal point. If you do not know your

permanent rate limit, contact your county assessor, or the

Identify by category

Department of Revenue, Finance and Taxation Team.

For every item described in Part IV, show the total amount

Line 8. If you are a new district that had its permanent rate

in the column for the appropriate category. These catego-

limit established by the voters, enter the date of the elec-

ries are:

tion in which your rate limit was approved. You only need

General government. Generally, these are taxes imposed

to complete this line for the first year your new permanent

by a unit of government whose main purpose is to perform

rate limit is certified. If you use line 8, include a copy of the

governmental operations other than educational services.

ballot measure with your certification.

Line 9. If your district went through a merger or consoli-

Excluded from limitation. These are taxes, fees, charges,

dation in 2003–04, show your estimated permanent rate

and special assessments not limited by Measure 5.

limit on this line. Before taxes are extended on the roll for

If you have questions about the correct category of your

2004–05, the assessor will calculate a permanent rate limit

tax, consult your legal counsel and/or the statewide orga-

for your district using actual values. You will be notified

nization representing your district.

of the actual new permanent rate limit. If your estimated

rate is higher than the actual permanent rate limit, the as-

Use a separate line for each category. For example, a dis-

sessor will use the actual rate. If your estimated rate is less

trict may have a portion for operations and maintenance

than the actual permanent rate limit, the assessor will use

which would be under the General Government category.

the estimated rate.

This would be on one line. The district may have a portion

to pay for excluded bonded debt. This would be on a sepa-

Part III: Schedule of local option taxes

rate line.

Complete this schedule if you have one or more voter-ap-

List the specific charge(s) on the available line(s) under the

proved local option taxes. For each local option tax, list the

heading, “Description.”

purpose of the tax (operating or capital project), the date

Describe the tax, i.e., ad valorem, sewer assessment, or spe-

voters approved it, the first year the tax can be imposed,

cific unit of measurement. Determine the total of each type

the final year the tax will be imposed and the dollar amount

of charge. Place the total dollar figure in the appropriate

or rate authorized to be imposed each year.

category.

The information you provide in this schedule supports the

Attach a complete listing of properties, by assessor’s ac-

local option tax amounts on lines 2 and 3 in Part I.

count number, to which fees, charges, and assessments are

Part IV: Special assessments, fees,

imposed. Show the amount of the fees, charges, or assess-

ments which are imposed uniformly on the properties, i.e.,

and charges

each property will pay the same dollar amount. If the fees,

charges, or assessments are not uniform, i.e., the amounts

Who must use this portion of the form. Those districts and

are calculated differently for each property, show the

nongovernmental entities who exercise their option to

amount imposed on each property.

place their taxes (other than those certified on lines 1–6) or

other charges on the tax roll must certify to their county as-

If your district is using Part IV, you must enter the ORS

sessor by July 15, 2004, by completing this part of the form.

number that gives the district the authority to place the

If your district is imposing any of the following items, you

items on the tax roll in the space provided.

must declare them on this portion of the form:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4