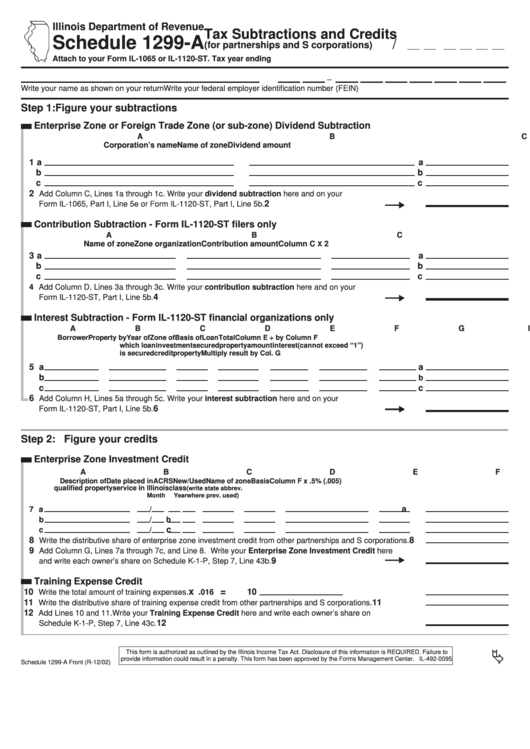

Schedule 1299-A - Tax Subtractions And Credits (For Partnerships And S Corporations)

ADVERTISEMENT

Illinois Department of Revenue

Tax Subtractions and Credits

Schedule 1299-A

/

(for partnerships and S corporations)

Attach to your Form IL-1065 or IL-1120-ST.

Tax year ending

–

Write your name as shown on your return

Write your federal employer identification number (FEIN)

Step 1: Figure your subtractions

Enterprise Zone or Foreign Trade Zone (or sub-zone) Dividend Subtraction

A

B

C

Corporation’s name

Name of zone

Dividend amount

1 a

a

b

b

c

c

2

Add Column C, Lines 1a through 1c. Write your dividend subtraction here and on your

2

Form IL-1065, Part I, Line 5e or Form IL-1120-ST, Part I, Line 5b.

Contribution Subtraction - Form IL-1120-ST filers only

A

B

C

D

Name of zone

Zone organization

Contribution amount

Column C

2

X

3 a

a

b

b

c

c

4 Add Column D, Lines 3a through 3c. Write your contribution subtraction here and on your

4

Form IL-1120-ST, Part I, Line 5b.

Interest Subtraction - Form IL-1120-ST financial organizations only

A

B

C

D

E

F

G

H

Borrower

Property by

Year of

Zone of

Basis of

Loan

Total

Column E ÷ by Column F

which loan

investment

secured

property

amount

interest

(cannot exceed “1”)

is secured

credit

property

Multiply result by Col. G

5 a

a

b

b

c

c

6

Add Column H, Lines 5a through 5c. Write your interest subtraction here and on your

6

Form IL-1120-ST, Part I, Line 5b.

Step 2: Figure your credits

Enterprise Zone Investment Credit

A

B

C

D

E

F

G

Description of

Date placed in

ACRS

New/Used

Name of zone

Basis

Column F x .5% (.005)

qualified property

service in Illinois

class

(write state abbrev.

Month

Year

where prev. used)

a

7 a

/

b

/

b

c

c

/

8

8

Write the distributive share of enterprise zone investment credit from other partnerships and S corporations.

9

Add Column G, Lines 7a through 7c, and Line 8. Write your Enterprise Zone Investment Credit here

9

and write each owner’s share on Schedule K-1-P , Step 7, Line 43b.

Training Expense Credit

x

=

10

.

10

Write the total amount of training expenses.

016

11

11

Write the distributive share of training expense credit from other partnerships and S corporations.

12

Add Lines 10 and 11. Write your Training Expense Credit here and write each owner’s share on

12

Schedule K-1-P, Step 7, Line 43c.

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is REQUIRED. Failure to

provide information could result in a penalty. This form has been approved by the Forms Management Center. IL-492-0095

Schedule 1299-A Front (R-12/02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2