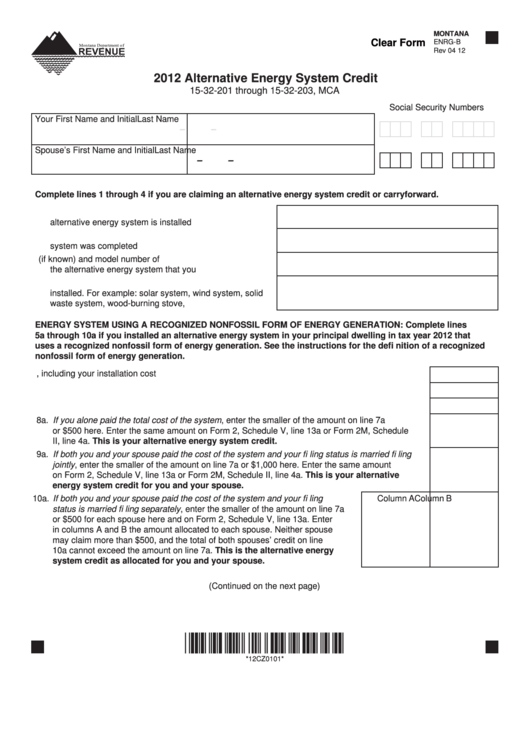

MONTANA

Clear Form

ENRG-B

Rev 04 12

2012 Alternative Energy System Credit

15-32-201 through 15-32-203, MCA

Social Security Numbers

Your First Name and Initial

Last Name

-

-

Spouse’s First Name and Initial

Last Name

-

-

Complete lines 1 through 4 if you are claiming an alternative energy system credit or carryforward.

1. Enter the physical address of your home where the

alternative energy system is installed .............................. 1.

2. Enter the date the installation of your alternative energy

system was completed .................................................... 2.

3. Enter the brand name (if known) and model number of

the alternative energy system that you installed.............. 3.

4. Enter the type of alternative energy system that you

installed. For example: solar system, wind system, solid

waste system, wood-burning stove, etc........................... 4.

ENERGY SYSTEM USING A RECOGNIZED NONFOSSIL FORM OF ENERGY GENERATION: Complete lines

5a through 10a if you installed an alternative energy system in your principal dwelling in tax year 2012 that

uses a recognized nonfossil form of energy generation. See the instructions for the defi nition of a recognized

nonfossil form of energy generation.

5a. Enter the cost of the system you installed, including your installation cost .................................. 5a.

6a. Enter the amount of any grants received for your system ............................................................ 6a.

7a. Subtract line 6a from line 5a and enter the result here................................................................. 7a.

8a. If you alone paid the total cost of the system, enter the smaller of the amount on line 7a

or $500 here. Enter the same amount on Form 2, Schedule V, line 13a or Form 2M, Schedule

II, line 4a. This is your alternative energy system credit. ....................................................... 8a.

9a. If both you and your spouse paid the cost of the system and your fi ling status is married fi ling

jointly, enter the smaller of the amount on line 7a or $1,000 here. Enter the same amount

on Form 2, Schedule V, line 13a or Form 2M, Schedule II, line 4a. This is your alternative

energy system credit for you and your spouse....................................................................... 9a.

10a. If both you and your spouse paid the cost of the system and your fi ling

Column A

Column B

status is married fi ling separately, enter the smaller of the amount on line 7a

or $500 for each spouse here and on Form 2, Schedule V, line 13a. Enter

in columns A and B the amount allocated to each spouse. Neither spouse

may claim more than $500, and the total of both spouses’ credit on line

10a cannot exceed the amount on line 7a. This is the alternative energy

system credit as allocated for you and your spouse. ..............................10a.

(Continued on the next page)

*12CZ0101*

*12CZ0101*

1

1 2

2 3

3