Wyoming Voluntary Disclosure Agreement Form (2007)

ADVERTISEMENT

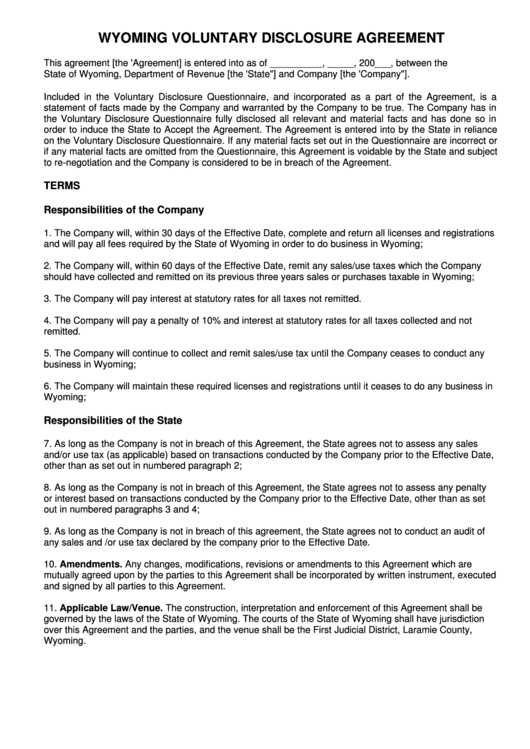

WYOMING VOLUNTARY DISCLOSURE AGREEMENT

This agreement [the 'Agreement] is entered into as of __________, _____, 200___, between the

State of Wyoming, Department of Revenue [the 'State"] and Company [the 'Company"].

Included in the Voluntary Disclosure Questionnaire, and incorporated as a part of the Agreement, is a

statement of facts made by the Company and warranted by the Company to be true. The Company has in

the Voluntary Disclosure Questionnaire fully disclosed all relevant and material facts and has done so in

order to induce the State to Accept the Agreement. The Agreement is entered into by the State in reliance

on the Voluntary Disclosure Questionnaire. If any material facts set out in the Questionnaire are incorrect or

if any material facts are omitted from the Questionnaire, this Agreement is voidable by the State and subject

to re-negotiation and the Company is considered to be in breach of the Agreement.

TERMS

Responsibilities of the Company

1. The Company will, within 30 days of the Effective Date, complete and return all licenses and registrations

and will pay all fees required by the State of Wyoming in order to do business in Wyoming;

2. The Company will, within 60 days of the Effective Date, remit any sales/use taxes which the Company

should have collected and remitted on its previous three years sales or purchases taxable in Wyoming;

3. The Company will pay interest at statutory rates for all taxes not remitted.

4. The Company will pay a penalty of 10% and interest at statutory rates for all taxes collected and not

remitted.

5. The Company will continue to collect and remit sales/use tax until the Company ceases to conduct any

business in Wyoming;

6. The Company will maintain these required licenses and registrations until it ceases to do any business in

Wyoming;

Responsibilities of the State

7. As long as the Company is not in breach of this Agreement, the State agrees not to assess any sales

and/or use tax (as applicable) based on transactions conducted by the Company prior to the Effective Date,

other than as set out in numbered paragraph 2;

8. As long as the Company is not in breach of this Agreement, the State agrees not to assess any penalty

or interest based on transactions conducted by the Company prior to the Effective Date, other than as set

out in numbered paragraphs 3 and 4;

9. As long as the Company is not in breach of this agreement, the State agrees not to conduct an audit of

any sales and /or use tax declared by the company prior to the Effective Date.

10. Amendments. Any changes, modifications, revisions or amendments to this Agreement which are

mutually agreed upon by the parties to this Agreement shall be incorporated by written instrument, executed

and signed by all parties to this Agreement.

11. Applicable Law/Venue. The construction, interpretation and enforcement of this Agreement shall be

governed by the laws of the State of Wyoming. The courts of the State of Wyoming shall have jurisdiction

over this Agreement and the parties, and the venue shall be the First Judicial District, Laramie County,

Wyoming.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2