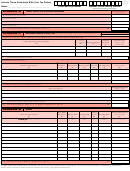

Form Dr-601i - Florida Intangible Personal Property Tax Return For Individual And Joint Filers - 2005 Page 2

ADVERTISEMENT

DR-601I

R. 01/05

Important Information Requested

Month

Day

Year

1.

If this is your first year filing, what is the date that your

Example:

0 6 1 0 2 0 0 4

M M D D Y Y Y Y

Florida residency was established?

These two items may assist you in establishing a residency date:

A) The first year you qualified for homestead exemption. B) The first day you were qualified to register to vote in Florida.

2.

Do you reside outside Florida during a portion of the year?

Yes

No

If yes, enter your non-Florida address: ___________________________________________________________________________

When do you normally reside there? from________ until________ Phone number at above address: ( _____ )-_______-__________ .

3.

If your filing status has changed or is incorrect, please complete the information below:

A) Marriage

B) Divorce

C) Death (See Instructions, Filing Status , Page 7.)

M M D D Y Y Y Y

M M D D Y Y Y Y

M M D D Y Y Y Y

Date of Marriage

Date of Divorce

Date of Death

Spouse’s SSN

Your SSN

SSN of Deceased

4.

If your name/mailing address/SSN has changed or is incorrect, complete the following:

Taxpayer #1

Taxpayer #2

Name

_________________________________________________

Name

______________________________________________________

Correct SSN

____________________________________________

Correct SSN

________________________________________________

New Address

___________________________________________

New Address

________________________________________________

City/State/ZIP

___________________________________________

City/State/ZIP

_______________________________________________

Telephone Number

( __________ ) __________________________

Telephone Number

( ___________ ) _____________________________

Signature

______________________________________________

Signature

___________________________________________________

Tax Calculation Worksheet

(Complete only ONE column below)

Instructions: Determine which column applies based on filing

status. Complete only the applicable column.

Individual

Joint

1. Enter Total Taxable Intangible Assets from Schedule A, Line 5

$

$

2. Subtract Personal Exemption

– $250,000

– $500,000

3. Taxable Assets

$

$

4. Multiply by Tax Rate

x .001

x .001

5. Total Tax Due, Carry Amount to Schedule A, Line 6

If the Total Tax Due is less than $60, you do not need

to file or pay.

$

$

601-I

Make check payable to:Florida Department of Revenue

(Include SSN on check)

Mail to:

Florida Department of Revenue

Do not mark in this area.

5050 W Tennessee St

Tallahassee FL 32399-0140

Neither foreign currency nor funds drawn on other than

U.S. banks will be accepted. State law requires a service

fee for returned checks or drafts of fifteen ($15) dollars or

five (5%) percent of the face amount, whichever is

greater, not to exceed $150 [s.215.34(2), F.S.].

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4